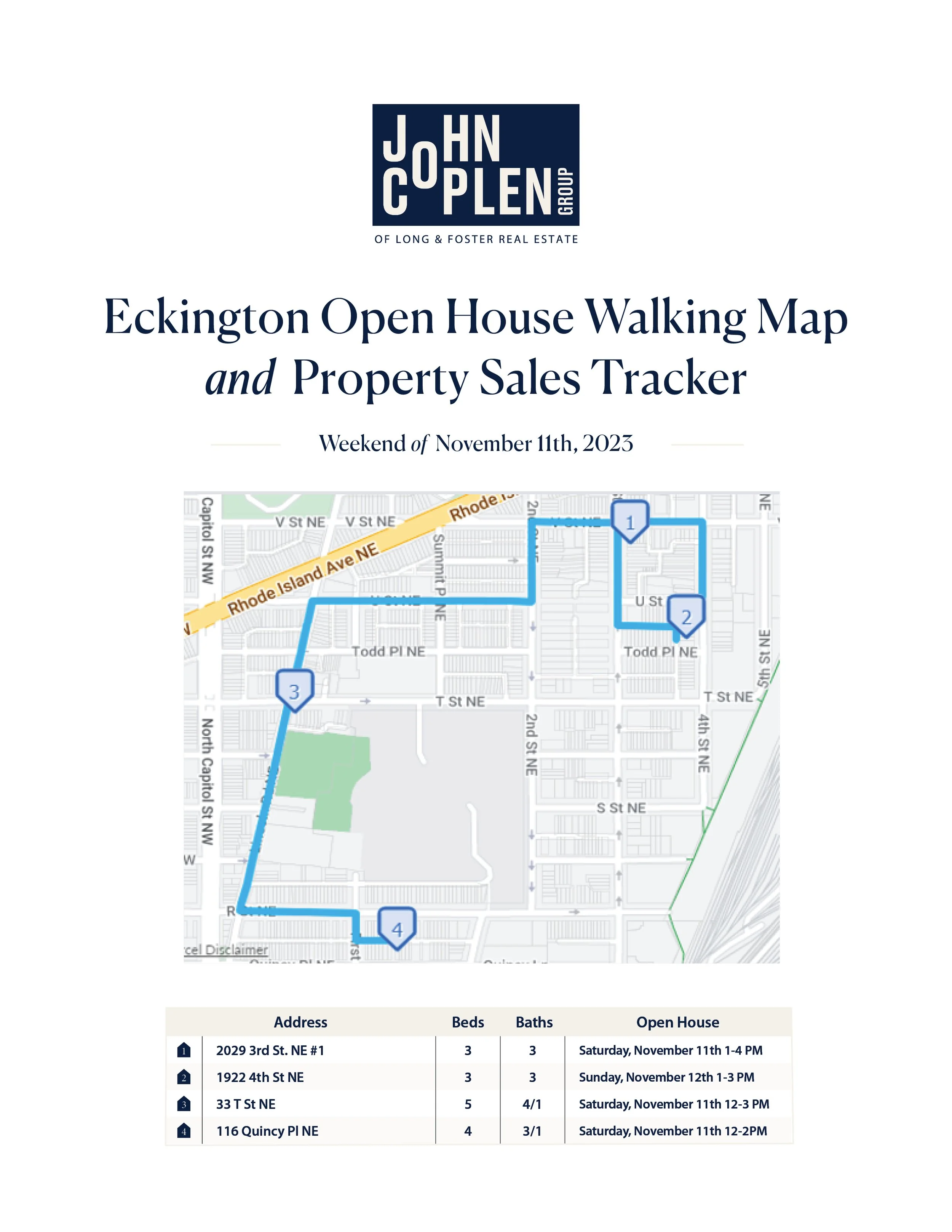

Eckington By The Numbers || Weekend 11.11.23

We often hear that the holiday season is not a great time to list your property, but I would argue there are some big advantages.

Holiday Curb Appeal: Enhance the exterior of your home with festive decorations and well-maintained landscaping to attract potential buyers during the holiday season.

Warm and Cozy Atmosphere: Create a welcoming ambiance inside your home soft lighting, and perhaps a crackling fire in the fireplace to make potential buyers feel at home.

Year-End Tax Benefits: Highlight the potential tax advantages of purchasing a home before the year ends, emphasizing the financial benefits of closing the deal during the holiday season.

Less Market Competition: Point out that the holiday season often sees fewer homes on the market, providing your property with a competitive edge and potentially attracting more serious buyers.

New Beginnings for the New Year: Emphasize the idea of a fresh start in a new home for the upcoming year, appealing to buyers who may be looking to make a significant change in their lives.

Emphasize Indoor Spaces: Showcase the interior of your home by staging key rooms for winter, allowing potential buyers to envision themselves celebrating holidays in the space.

Holiday Home Tours: Consider hosting open houses or private tours with holiday-themed refreshments to make the home-buying process more enjoyable for potential buyers.

Motivated Buyers: Many individuals looking to purchase during the holiday season are often motivated by a specific timeline, such as relocating for a job or taking advantage of year-end financial considerations.

Negotiation Leverage: Position your home as a desirable option, noting that serious buyers may be more willing to negotiate and close a deal during the holiday season, potentially resulting in a quicker and smoother transaction.

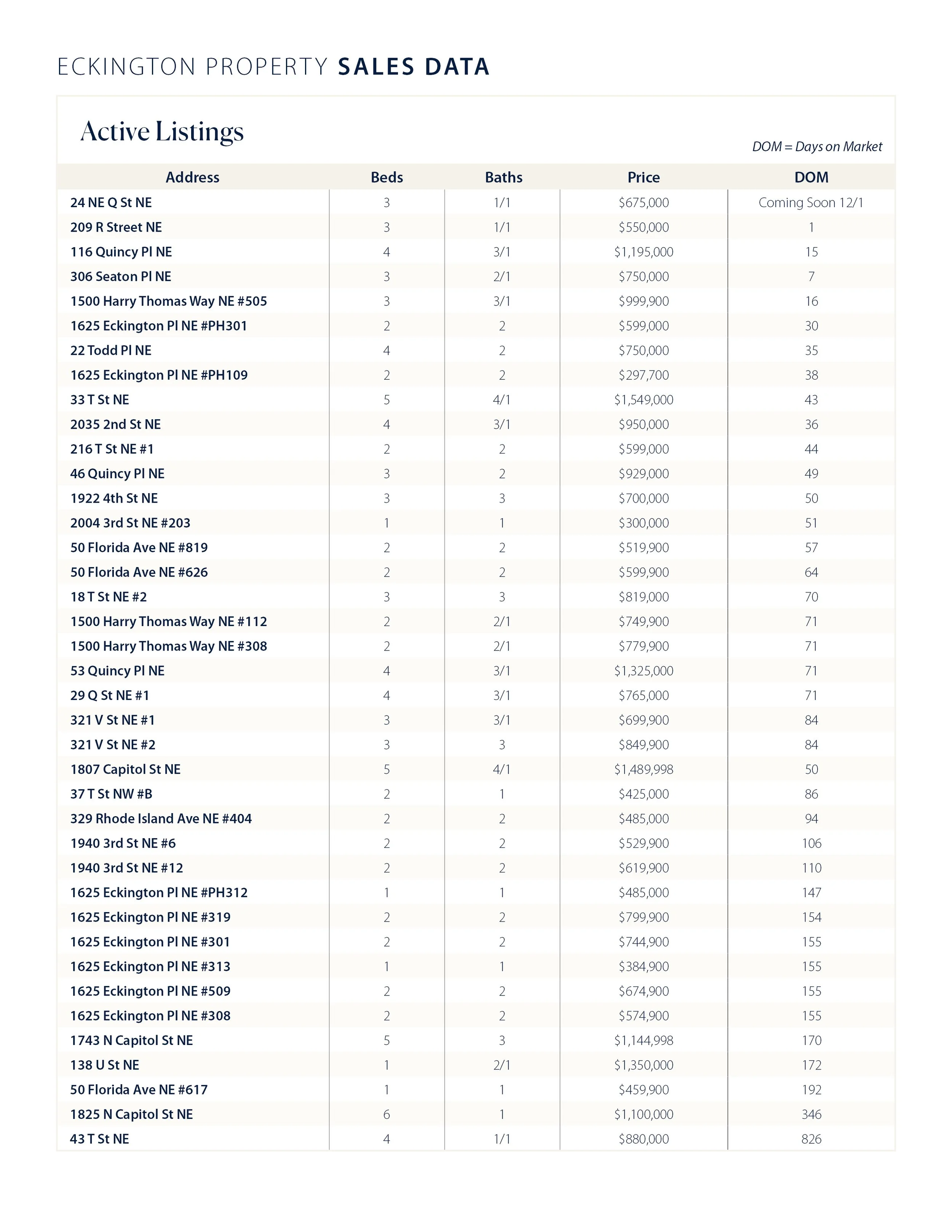

Eckington By The Numbers || Weekend 11.05.23

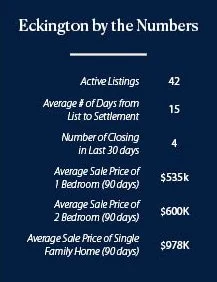

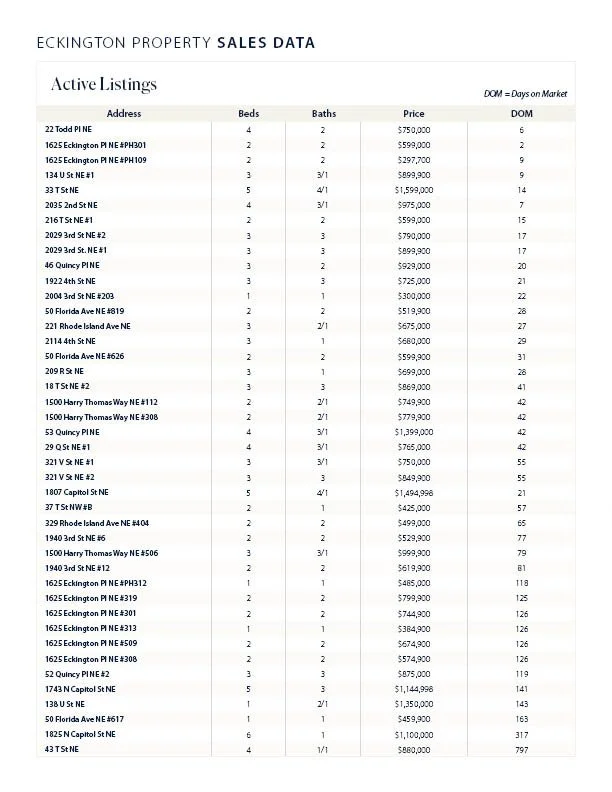

Taking a look at Eckington's data this week, the number of active listings dropped from 40 to 41, and there have been a total of 9 closings in the last 30 days. The average days on the market jumped from 37 to 49. As we head into the holiday season, I would expect the inventory to drop some and the days on the market to rise. Every year I tell buyers this is a great time to buy if you can stay focused. There is often less competition in the market.

Some good news for buyers and sellers is that the Federal Reserve (Fed) decided to hold rates steady at last Wednesday's meeting. We often get a lot of questions about how rates work, so here is a quick overview. The Fed's set interest rates have a significant influence on mortgage rates, but they are not directly tied to each other. Mortgage rates are primarily determined by the broader bond market and investors' perceptions of risk and return in the housing market. When the Fed raises or lowers its benchmark interest rate, it affects the overall cost of borrowing money in the economy, including banks' cost of funds. As a result, mortgage rates tend to move in the same general direction as the Fed's policy rate changes. However, they can be influenced by other factors like economic indicators, inflation expectations, and demand for mortgage-backed securities. So while Fed rates provide a crucial backdrop, mortgage rates can vary independently, often resulting in disparities between the two. This directly impacts buyers, as for every rate hike, it means less house a buyer can afford. This move dropped the 30-year average fixed rate from 7.88% last Friday to 7.38% this Friday.

Here is a recnet article on the Fed's last meeting: https://www.reuters.com/markets/us/fed-poised-hold-rates-steady-despite-economys-bullish-tone-2023-11-01/

As of Friday, November 3, 2023, the current average interest rate for a 30-year fixed mortgage is 7.38%. *We source this data from Mortgage News Daily.

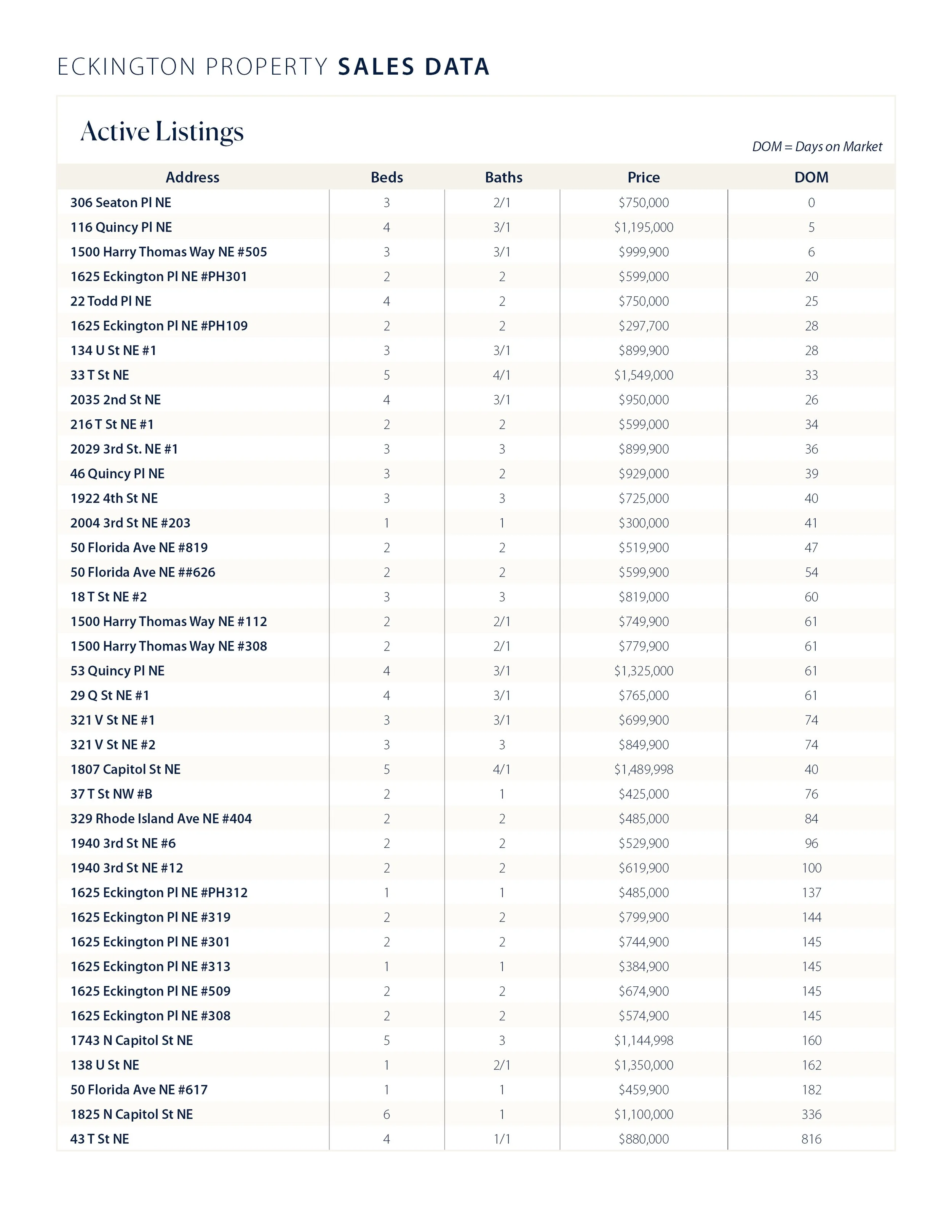

Eckington By The Numbers || Weekend 10.28.23

Taking a look at Eckington's data this week, the number of active listings dropped from 42 to 40, and there have been a total of 7 closings in the last 30 days. The average days on the market jumped from 15 to 37. This is further evidence that homes will move if priced right, just at a slower pace than what we are used to in the typical DC market.

We're also noticing numerous options available from lenders to help individuals secure a slightly lower interest rate now, with the idea that rates will potentially come down in the future, allowing for refinancing. One particularly popular option is the 3-2-1 Buydown. This unique mortgage financing strategy is designed to reduce your initial monthly mortgage payments, making them more manageable during the early years of your home loan. Here's how it works:

Year 1: You enjoy a significant reduction in your interest rate, a full 3 percentage points below the standard rate.

Year 2: Your interest rate continues to be favorable, now lowered by 2 percentage points below the standard rate.

Year 3: The interest rate is further reduced, this time by 1 percentage point below the standard rate.

This approach provides short-term payment relief, helping you transition into homeownership smoothly and efficiently. It's an excellent option for those looking to enter the housing market with more financial flexibility.

Eckington Day Was FUNN!

We enjoyed talking real estate with folks and hearing everyones thoughts on our neighborhood!

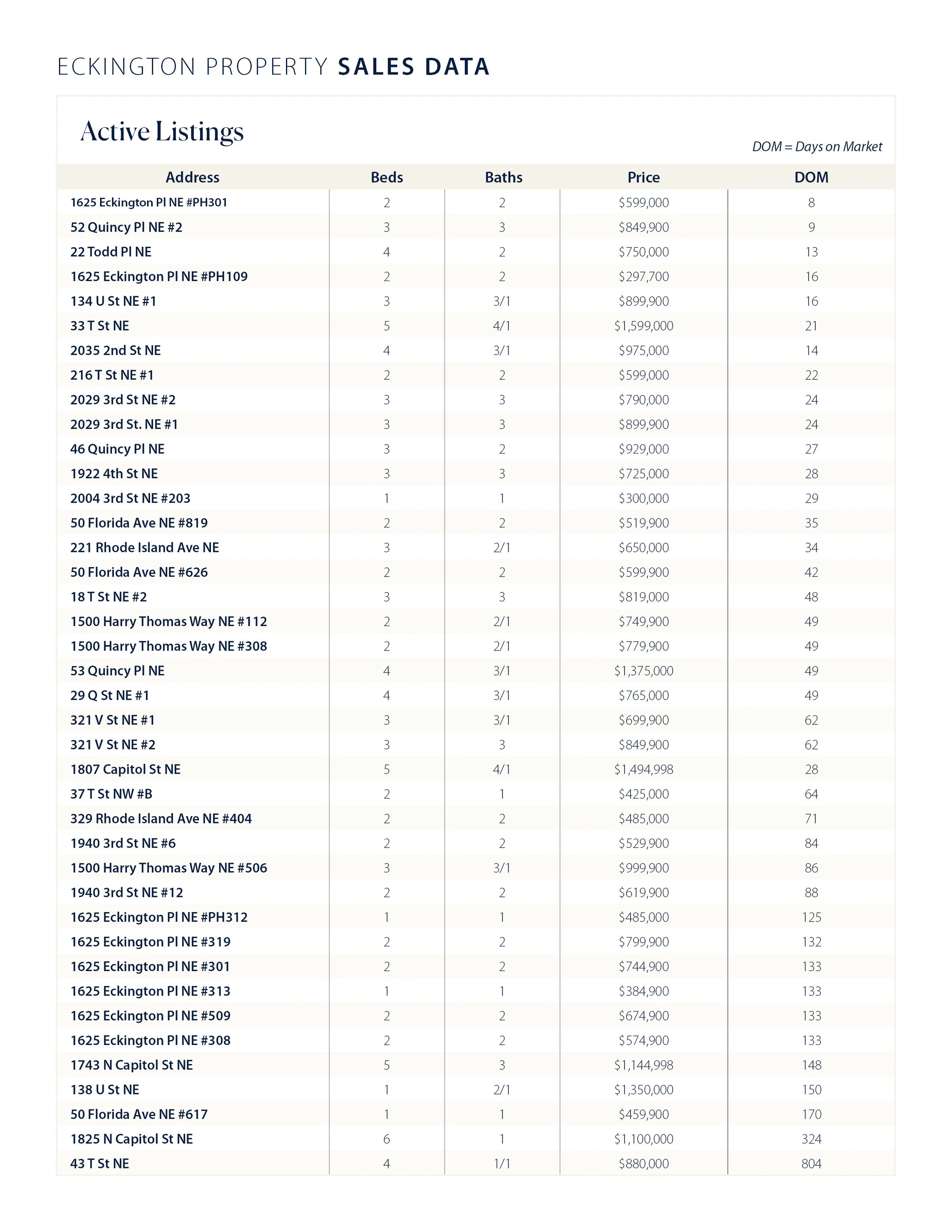

Eckington By The Numbers || Weekend 10.21.23

Here's something worth considering: If you're a buyer, would you rather be in our typical DC market, where you find yourself competing with five other people, having to pay an extra $50,000 just to secure the winning bid, and often forgoing inspections and other protective contingencies? Or would you prefer to be in this market, where you can purchase a home at the asking price and take your time to conduct due diligence without feeling rushed? It's important to note that anyone obtaining a mortgage at the present time can later refinance when interest rates drop. This is something you can control. On the other hand, once you've purchased your home, you can't go back and renegotiate the price. Smart buyers are taking advantage of the current market conditions, understanding that it will benefit them in the long run.