Eckington By The Numbers || Weekend 04.06.2024

Coplen, John via googlegroups.com

10:54 AM (4 minutes ago)

to Eckington, Alex

Happy Sunday!

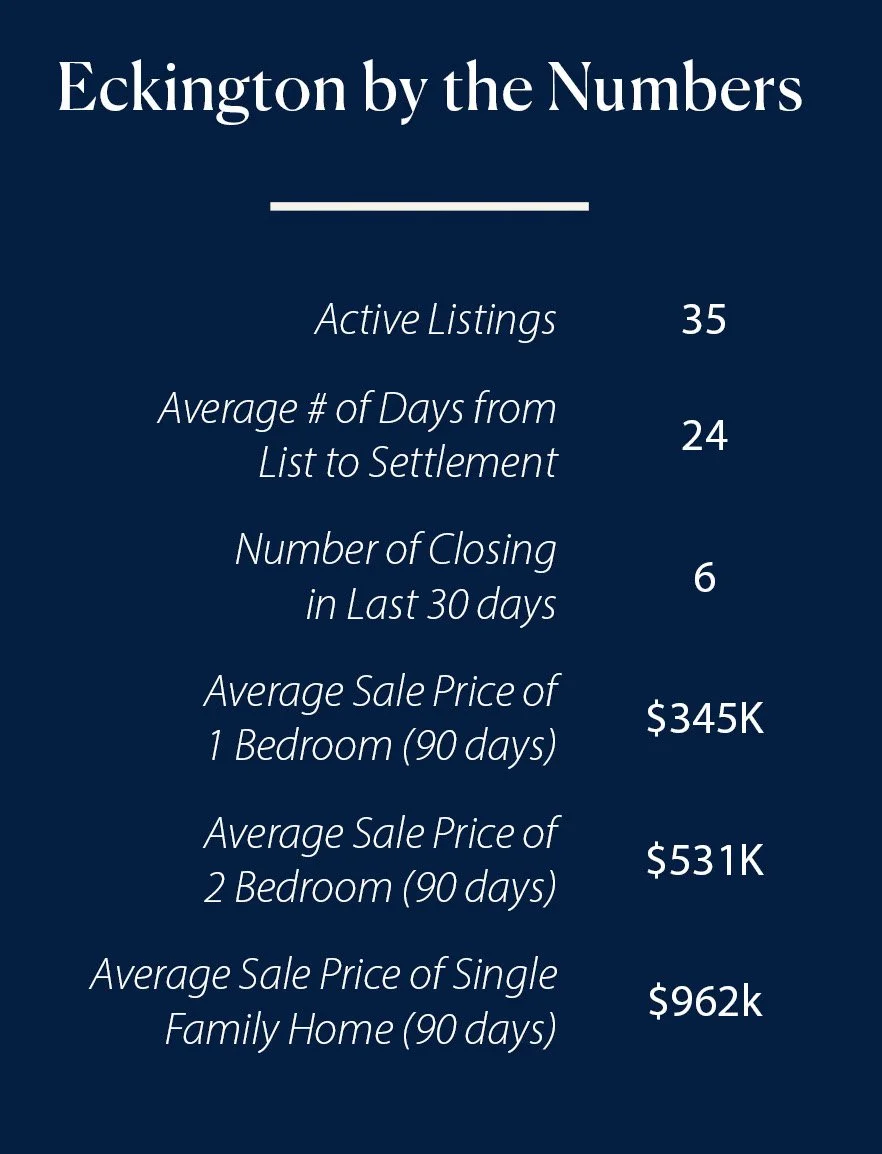

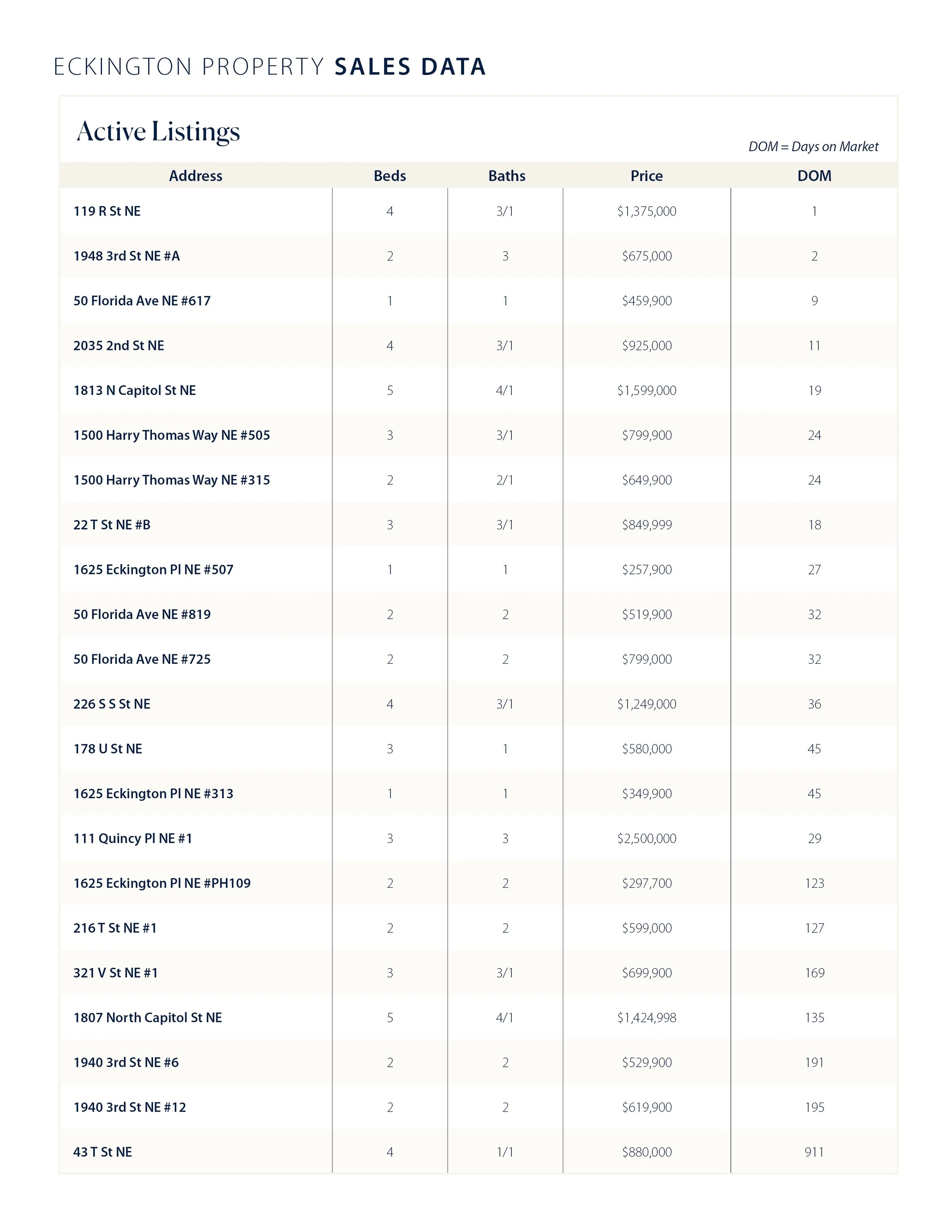

As we dive into this week's activity in Eckington, we've observed a slight increase in active listings, rising from 35 to 32, accompanied by a total of 6 closings in the last 30 days. Given the onset of the spring market, such fluctuations are not uncommon. Kindly find the full list of data below.

Here's some intriguing Eckington data: I've analyzed the average sales prices from January 1st to April 6th of each year dating back to 2021 for 1-bedroom condos, 2-bedroom condos, and townhouses in Eckington. Much of what I expected has materialized. The condo market has remained relatively flat compared to 2021 values, influenced by several factors. During Covid, many individuals who rented these units shifted to remote work, leading to homeowners listing their properties due to difficulties in finding renters. Moreover, last year saw an increase in rates, causing hesitation among potential condo buyers, particularly first-time homebuyers. With rates stabilizing since December, we are witnessing a slow shift in condo purchases, positioning the condo market slightly better, in my opinion. On the other hand, townhouses in Eckington continue to appreciate in value. Notably, several high-end renovation flips have fetched favorable prices for our neighborhood, with even unrenovated units experiencing price hikes. This trend is partly attributable to Eckington's growing popularity, bolstered by the completion of amenities like the dog park, Alethia Tanner Park. Breweries, proximenty to Union Market, and the MBT, which have attracted newcomers to our neighborhood. Relative to other neighborhoods, our price per square foot offers better value and a more central location. It's just a matter of time for everyone to recognize what we, as Eckington residents, already know.

1/1 to 4/6 EACH YEAR BACK TO 2021

2024

1 Bed Condo Average: $345,000

2 Bed Condo Average: $490,000

Townhouse Average: $1,013,166

2023

1 Bed Condo Average: No One Bedroom Sales

2 Bed Condo Average: $615,328.57

Townhouse Average: $771,625.00

2022

1 Bed Condo Average: $407,500.00

2 Bed Condo Average: $694,718.18

Townhouse Average: $922,017.00

2021

1 Bed Condo Average: $344,150

2 Bed Condo Average: $529,952.11

Townhouse Average: $803,631.82

Here is a bit about rates. As of Friday, April 5 2024, the current average interest rate for a 30-year fixed mortgage is 7.01%. *We source this data from Mortgage News Daily.

- DOWNLOAD - \\ ECKINGTON SALES TRACKER & OPEN HOUSE GUIDE // CLICK HERE

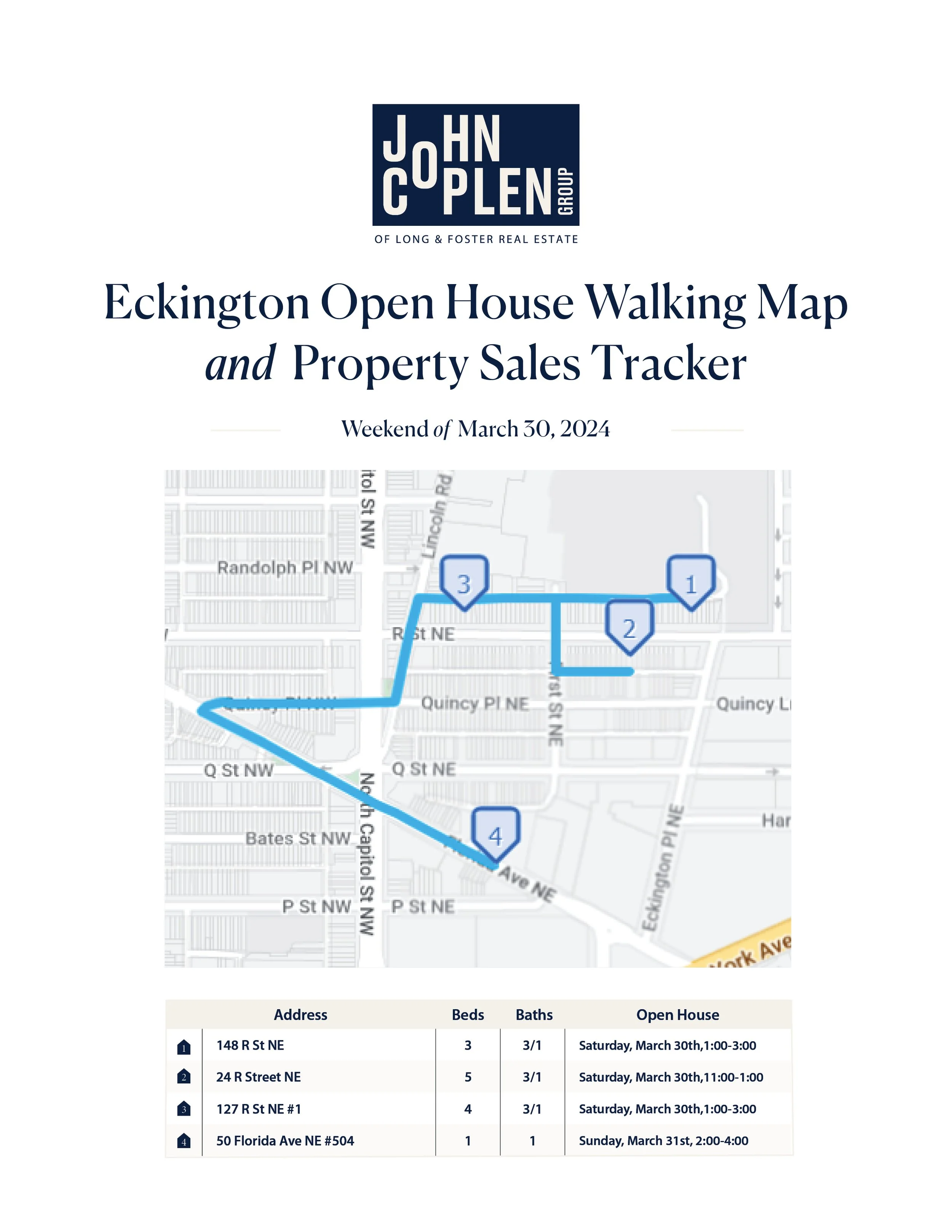

Eckington By The Numbers || Weekend 03.30.2024

We are receiving many questions regarding the recent lawsuit that may alter how Sellers offer commissions on their properties. Some of the coverage we've encountered is highly misleading and frankly incorrect. Here are a few things we anticipate happening:

Firstly, this won’t result in an immediate change. Even if Sellers are no longer able to offer a commission to the Buyer's agent on the MLS, there will still be other ways around it. For instance, Sellers aiming to market their homes in the best light may offer a credit for the Buyer's commission.

It will not necessarily lead to a decrease in the price of homes. The cost of the Buyer's agent, in some cases, may then be transferred to the Buyer. This makes the home buying process more expensive for first-time buyers, as they will not be able to finance that cost into the purchase of a home.

There will likely be much more confusion regarding the price of a home. For instance, if a home is listed for $600,000 but doesn’t offer a credit to the Buyer's Agent's commission, then the actual price of that home is $618,000. However, the additional $18,000 cannot be financed, resulting in additional cash out of pocket for Buyers.

So, what is our immediate advice? Don’t change anything for now. Don’t delay listing your home or rush into buying. Changes like this take time, and there are still several appeals in process. Even if the change takes place, our belief is that most Sellers will still offer to pay a Buyer’s Agent Commission to keep their home competitive, although it will be done in a different way with several new legal forms to sign. If you need to list, do what is right for you now and move forward with it.

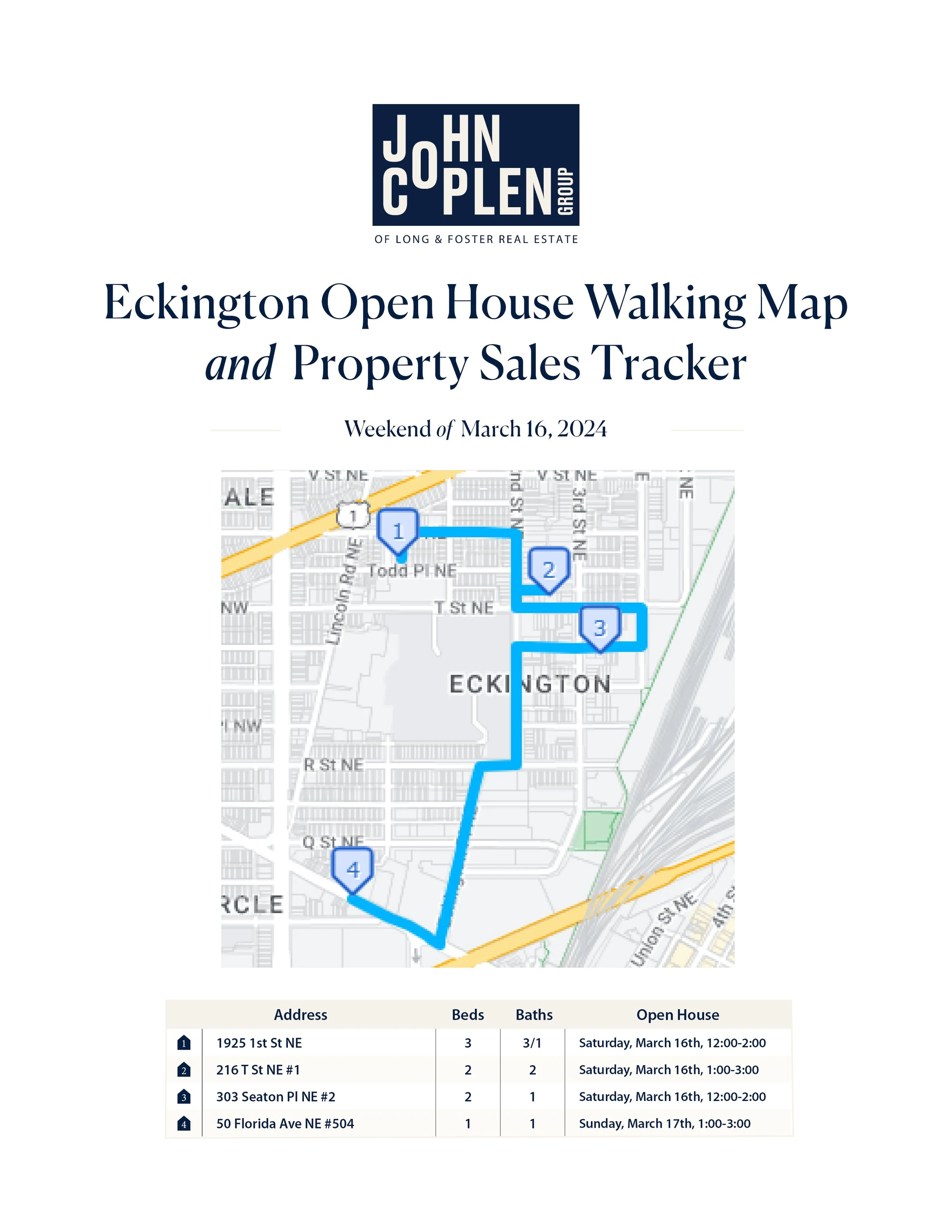

Eckington By The Numbers || Weekend 03.17.2024

Happy Sunday!

As we delve into this week's activity in Eckington, we've noted a slight increase in active listings, rising from 25 to 30, accompanied by a total of 7 closings in the last 30 days. From 1/1/23 to 3/17/23, 22 homes had closed in Eckington, while in the same period this year, we've closed 15 homes in Eckington. This beginning feels reminiscent of 2023 in DC to me. Homes that are priced appropriately and offer good quality are swiftly moving to closing. Despite a somewhat sluggish condo market, well-positioned units eventually find buyers. A good success story on pricing: 134 R Street NE sold in just 4 days on the market. If you look at the home's pricing compared to similar size homes, it was priced perfectly to attract immediate offers. In a market with some headwinds, that's how to move a property quickly.

At bit about rates. As of Friday, March 15 2024, the current average interest rate for a 30-year fixed mortgage is 7.09%. *We source this data from Mortgage News Daily.

- DOWNLOAD - \\ ECKINGTON SALES TRACKER & OPEN HOUSE GUIDE // CLICK HERE

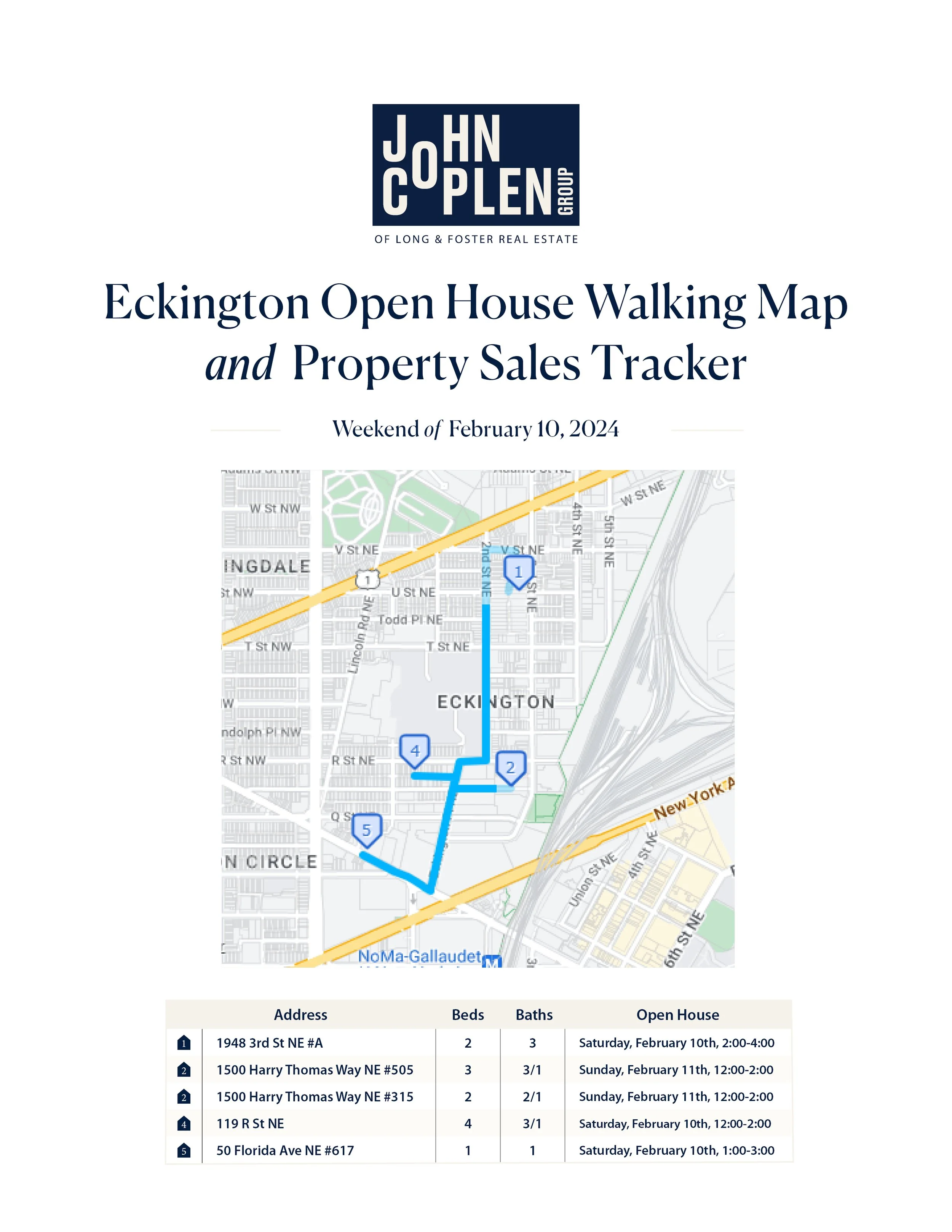

Eckington By The Numbers || Weekend 02.10.2024

Happy Super Bowl Sunday!

As we delve into this week's activity in Eckington, we've noticed a slight increase in active listings from 21 to 22, coupled with a total of 4 closings in the last 30 days. While it may feel premature, experience tells us that the week following Super Bowl Sunday often signals the beginning of the spring real estate market for us in the DMV.

Why is that, you might wonder? Well, it's simple. Many prospective sellers prefer not to enter the market on game day or even over the weekend, opting to hold off until afterwards. Plus, after the holiday season, we're all slowly emerging from our festive stupor. Now is the time when homeowners begin to focus on preparing their properties for sale, initiating conversations with their agents, and tackling necessary tasks.

Currently, we're actively assisting 4 clients in preparing their homes for listing, coordinating interior paint, and minor repairs. These things take time. It's worth contemplating – by March, thoughts will turn to spring yard clean-ups, and before we know it, we'll be enjoying the first hints of shorts weather.

Remember, it's never too early to kickstart the process. The sooner you dive in, the less stress it creates, and the better your home will present to the market. This leaves you plenty of time to nail it on marketing, including video, floor plans, and picking the perfect listing launch date. That should translate into a higher sales price for you.

At bit about rates. As of Friday, February 9, 2024, the current average interest rate for a 30-year fixed mortgage is 6.98%. *We source this data from Mortgage News Daily.

- DOWNLOAD - \\ ECKINGTON SALES TRACKER & OPEN HOUSE GUIDE // CLICK HERE

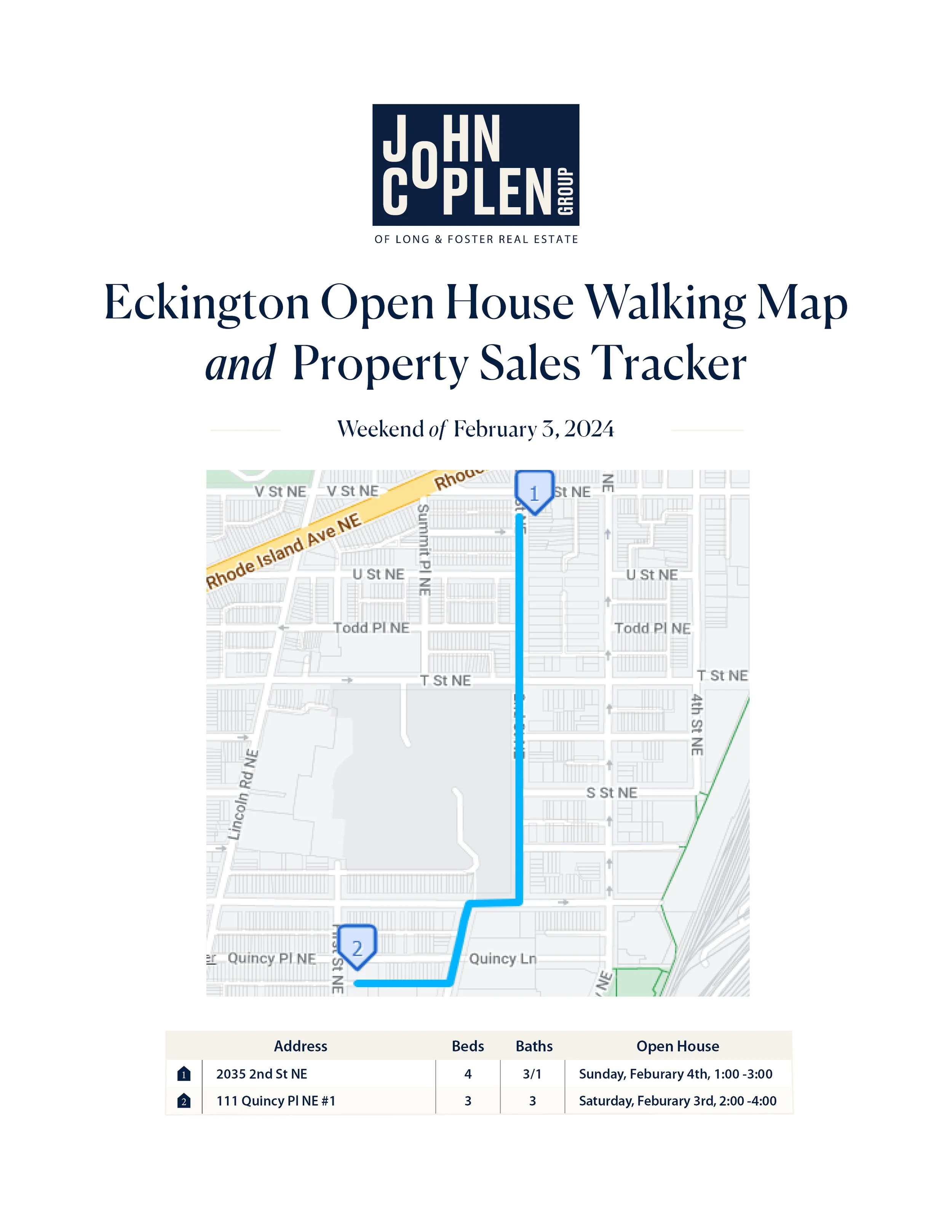

Eckington By The Numbers || Weekend 02.03.2024

Happy Sunday Eckington!

Taking a closer look at this week's activity in Eckington, we observed a decrease in active listings from 23 to 21, with a total of 3 closings in the last 30 days. In January 2024, we had 7 closings, surpassing the 6 closings in January 2023, but falling short of the 14 closings in January 2022.. It's worth noting that January 2022 still benefited from historically low-interest rates.

The positive news is that the Eckington market is moving at a slightly better pace than last year. However, a more extensive dataset is required to assess the trend thoroughly. If interest rates continue to decline, as widely expected, I anticipate surpassing last year's numbers.

As of Friday, February 2, 2024, the current average interest rate for a 30-year fixed mortgage is 6.92%. We source this data from Mortgage News Daily.

Another noteworthy data point is the highest residential sale on record for Eckington at 22 Q St NE, Washington, DC 20002, closing on 7/31/23 at $1,600,000.

An intriguing prospect is the listing at the Eckington School, 111 Quincy Pl NE #1, Washington, DC 20002, currently listed for $2,500,000. If this property succeeds, it will significantly surpass the highest sale in Eckington. Not only does it exceed in value, but it also boasts an impressive size of 5,863 sq ft. I personally toured the home with a client last week, and it is indeed a unique and special place. As a former architect, I appreciate distinctive spaces. While other cities often have unique buildings from former working harbors, DC never had that. DC's adaptive reuse projects frequently involve schools, churches, and some warehouse/garage-like spaces.