Eckington By The Numbers || Weekend 09.20.2024

The Federal Reserve Just Cut Rates for the First Time Since COVID

Let that sink in. Doesn't COVID feel like a lifetime ago? Well, that’s exactly why the real estate market has been facing so many headwinds. Rates peaked on October 19, 2023, with an average 30-year fixed mortgage at 8.01%. Those high rates not only made buyers pause, but sellers too. Why list your home if you’ll be facing a smaller pool of buyers and then have to buy in the same tough market?

So, what does this first rate cut of half a point mean? It means we're starting to see a shift. And now is the perfect time to take advantage of this changing market in ways you might not expect.

Where are rates now?

Currently, we’re seeing an average of 6% for a 30-year fixed mortgage. With the recent Fed cut and continued positive news on inflation, market rates are likely to dip even further. This slight downward shift will bring more buyers into the marketplace, especially as we head into the fall. Even though the upcoming election might make some hesitant, I believe we’ll see an uptick in activity.

Looking ahead to 2025

The Federal Reserve is widely expected to cut rates again before 2025. By the time spring rolls around, rates could be significantly lower. That’s when I predict the DC real estate market will be full speed ahead—think multiple offers, waived contingencies, and even bidding wars.

If you’re a seller, you might be thinking, "I’ll wait and sell then." That could work if you’re not buying at the same time. But if you are buying, there’s a sweet spot right now where rates are coming down and property values are more balanced. Buyers in certain segments may even find properties below market value.

I believe this window of opportunity lasts until January. After that, things will heat up fast. This is one of those rare moments when you get to choose your market conditions. So, what kind of market do you want to buy in? The choice seems clear to me—don’t sleep on this!

Eckington By The Numbers || Weekend 08.17.2024

Happy Sunday, Eckingtonians!

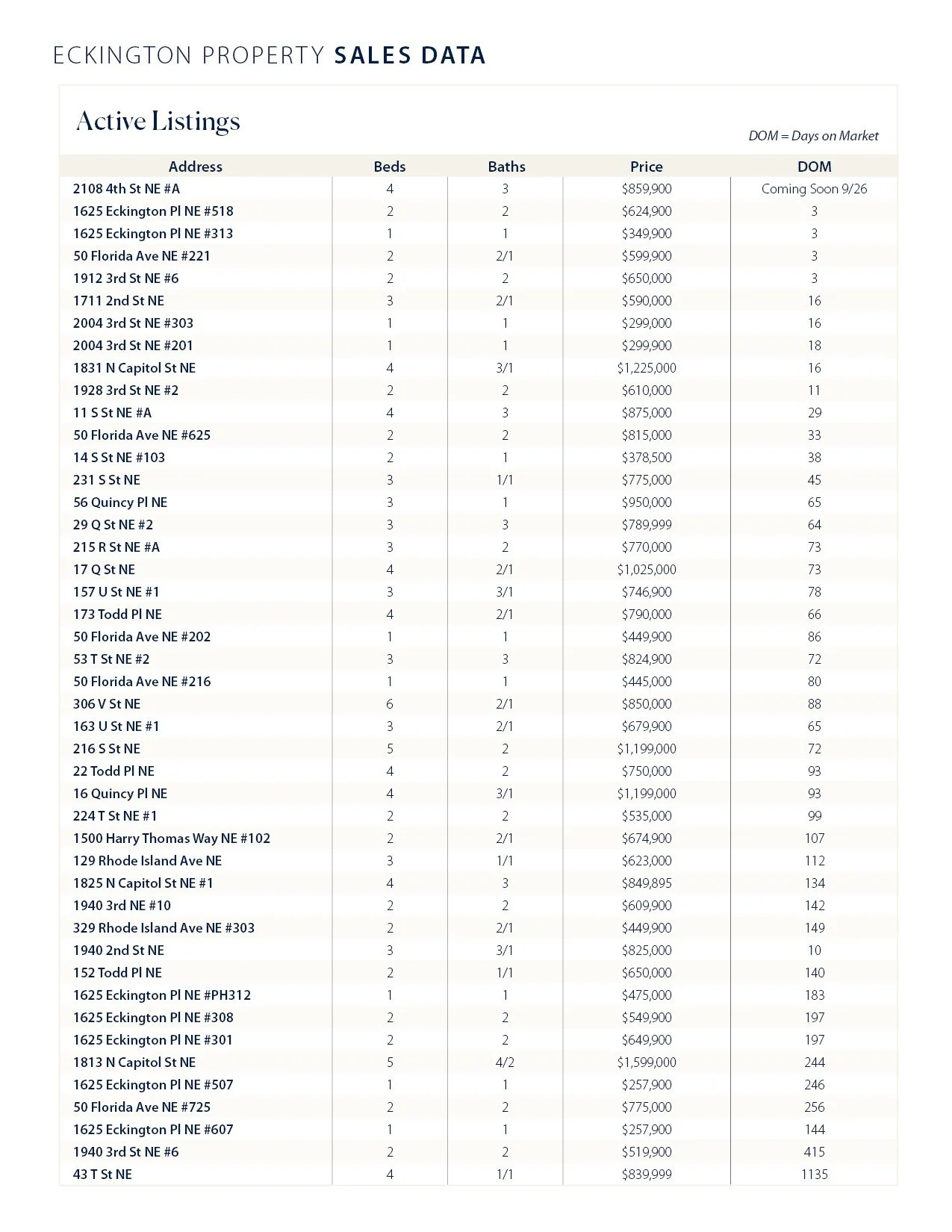

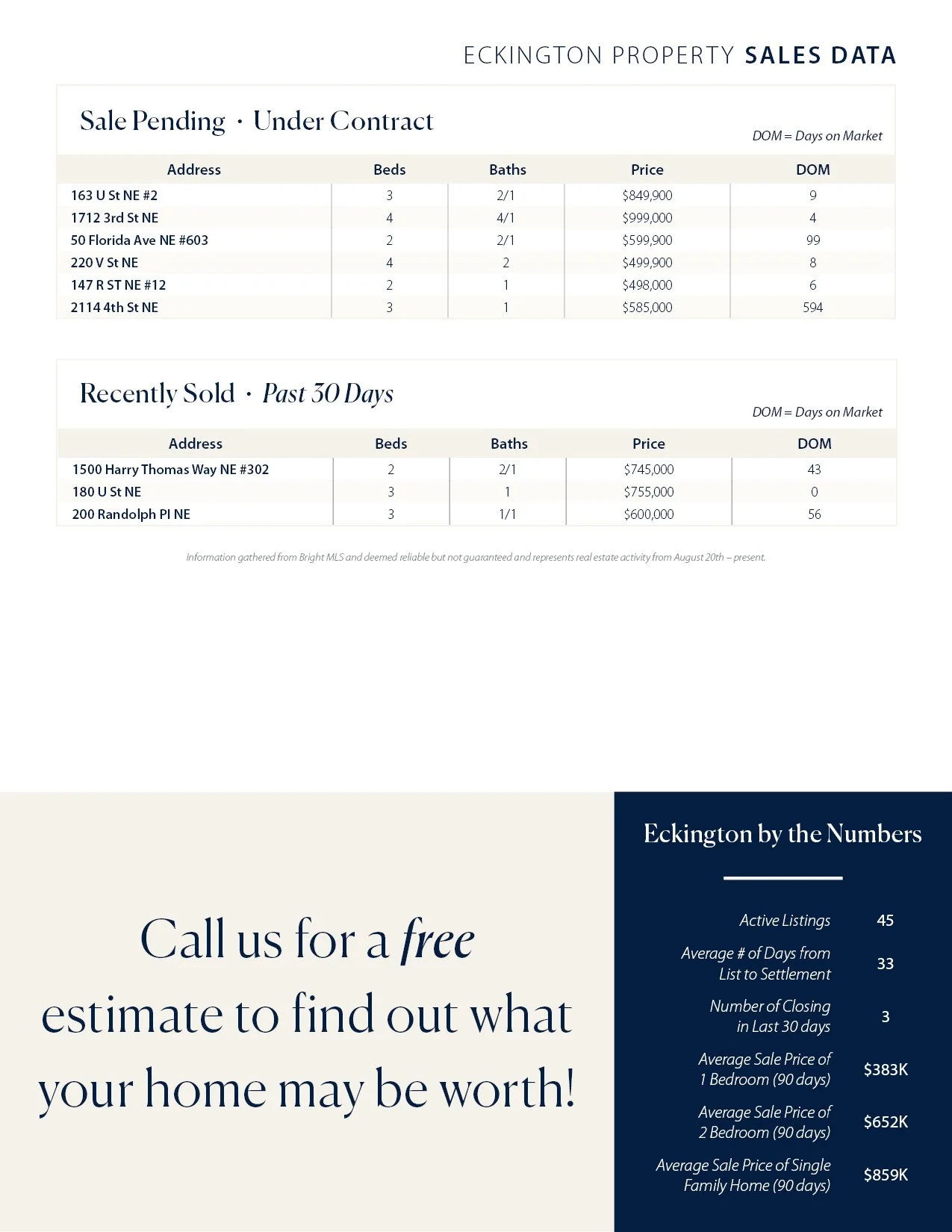

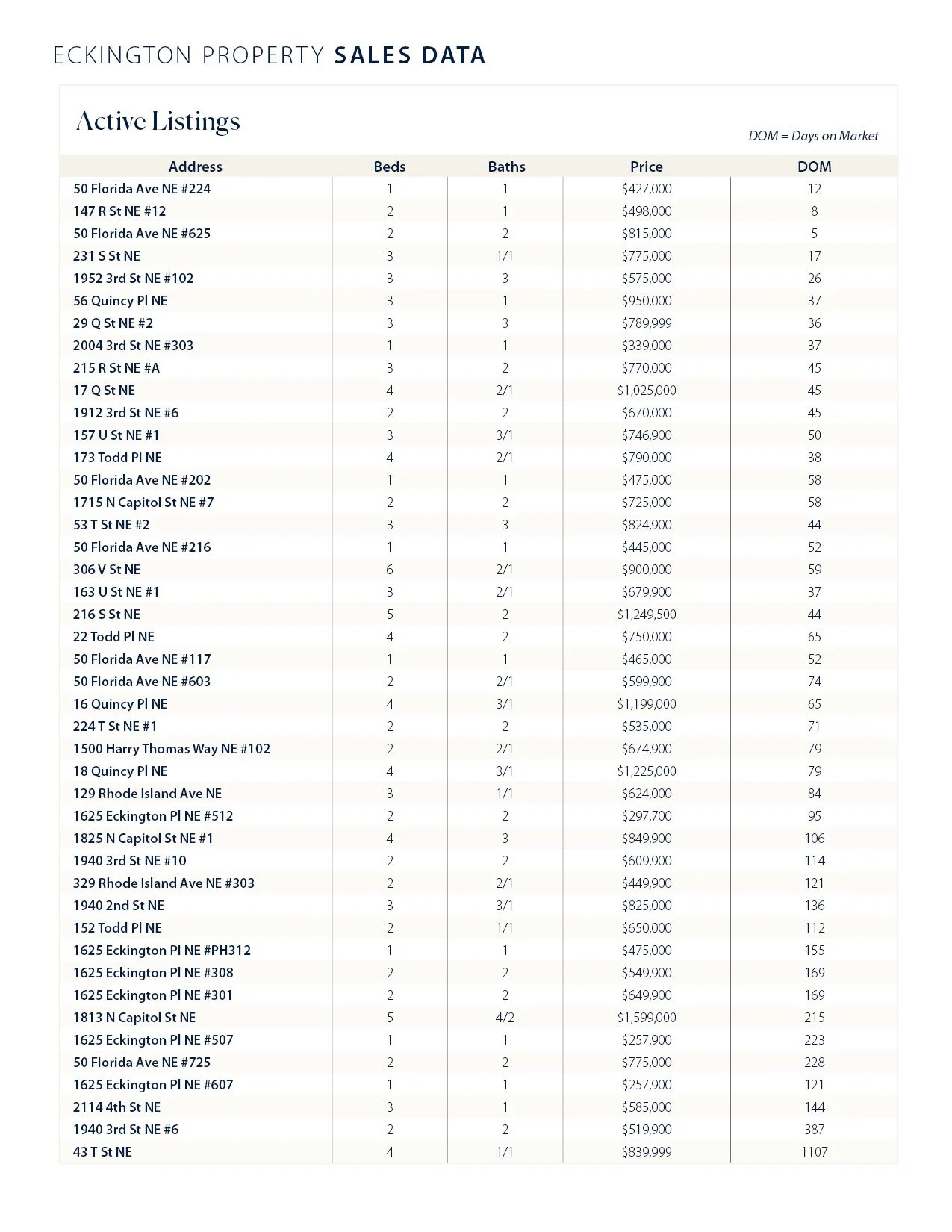

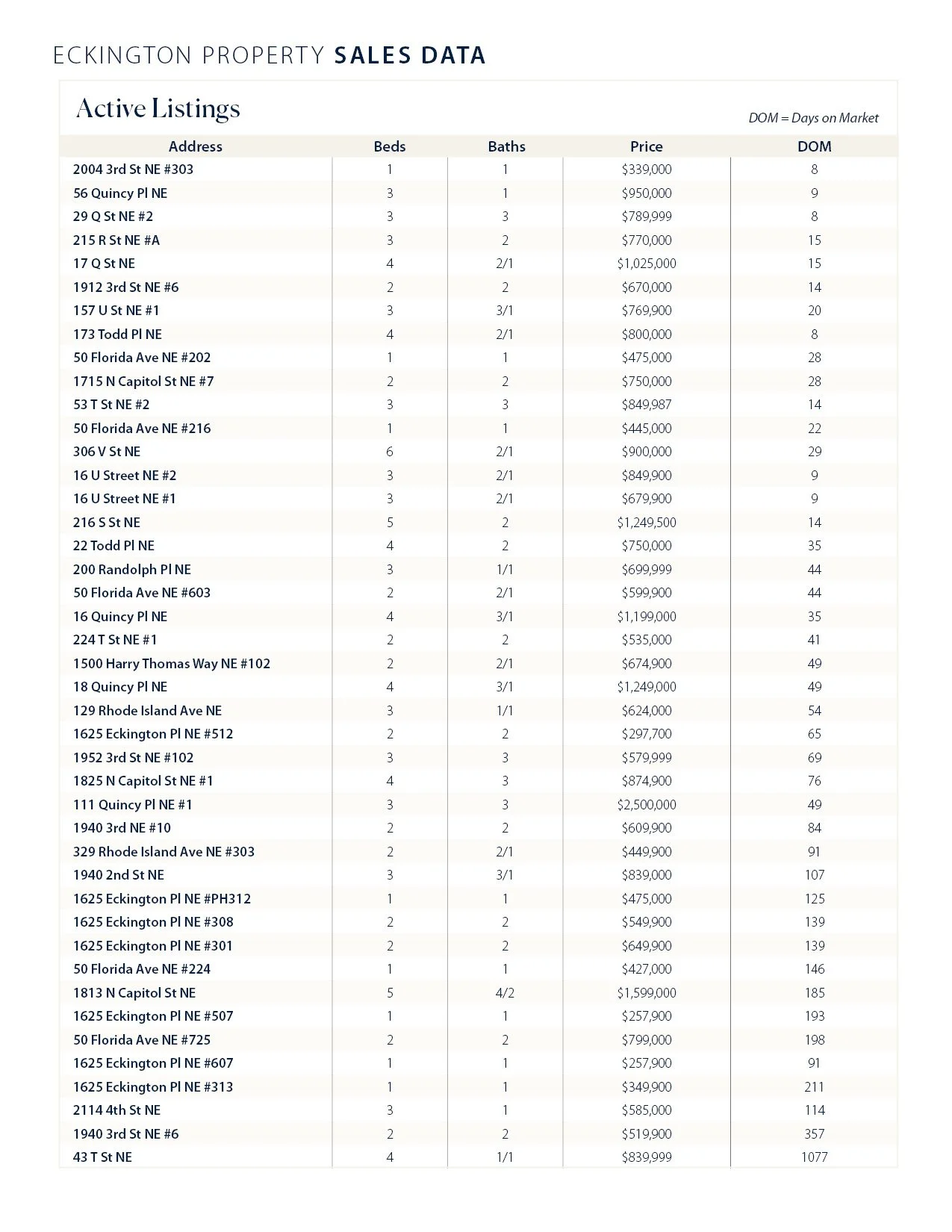

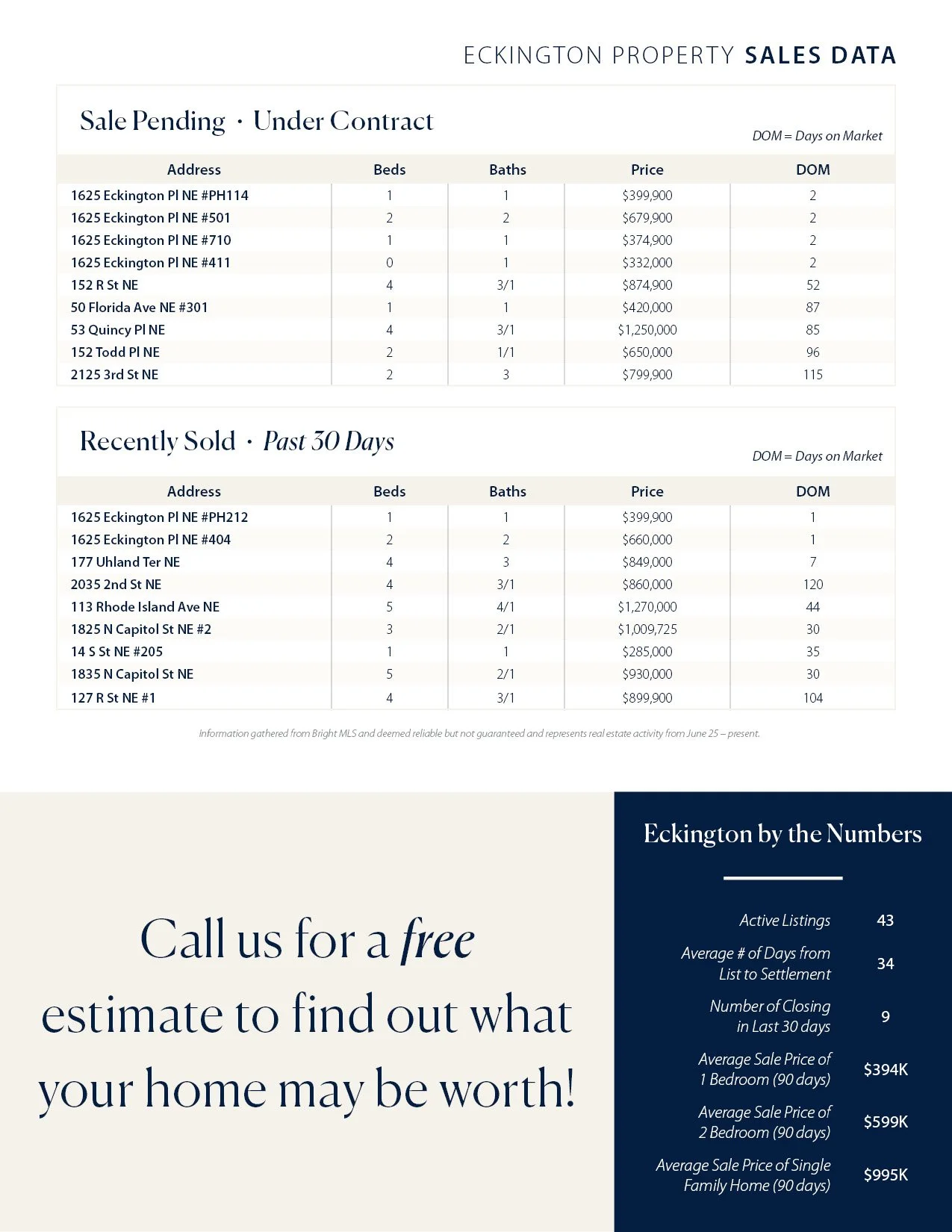

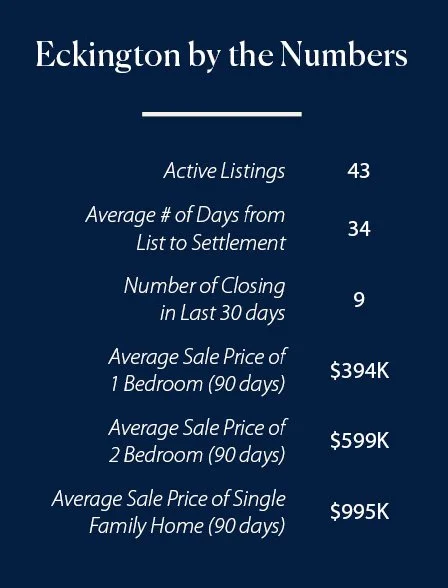

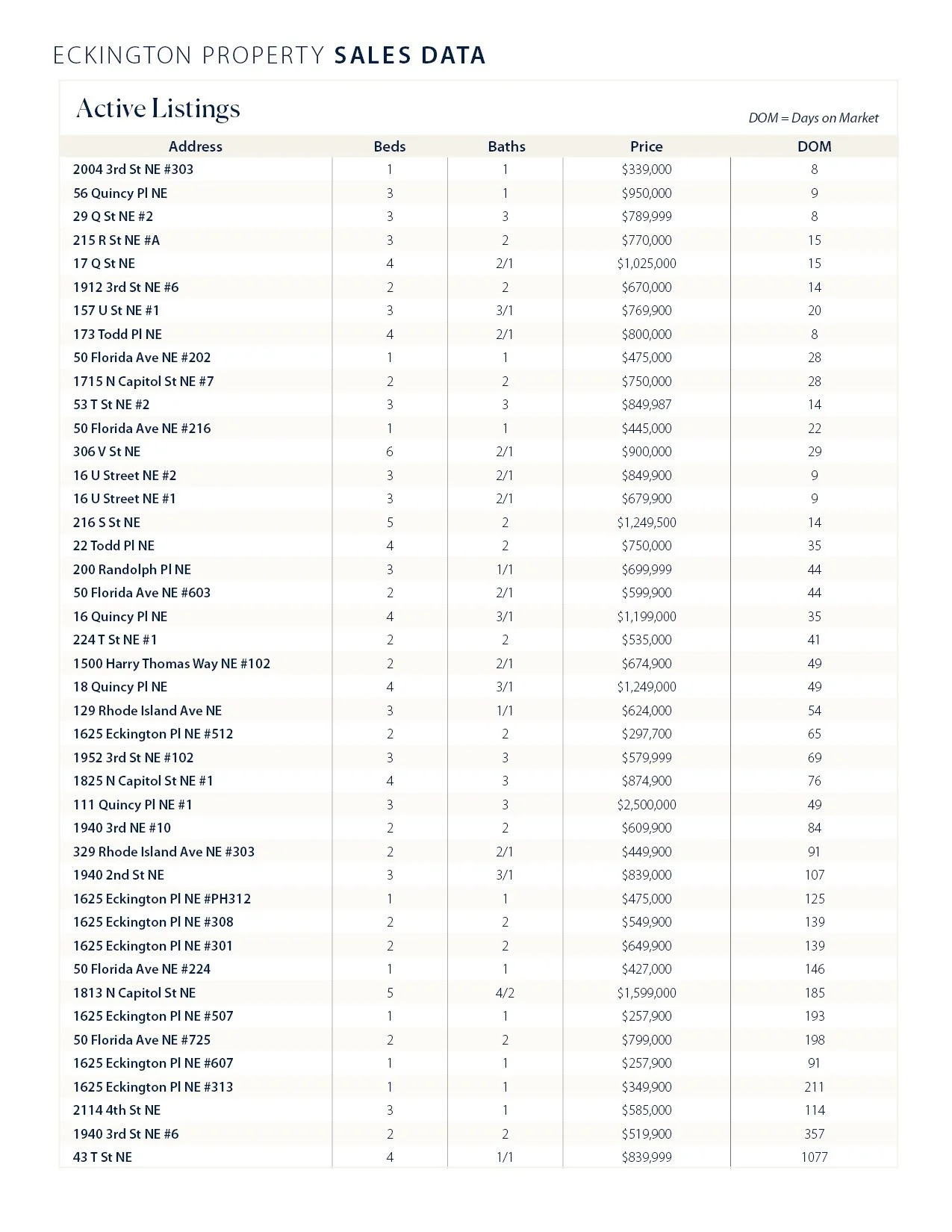

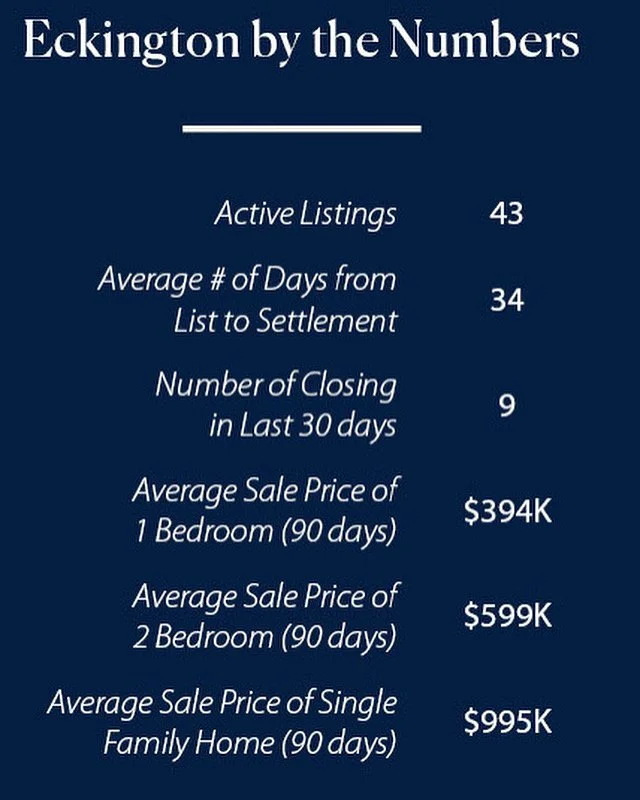

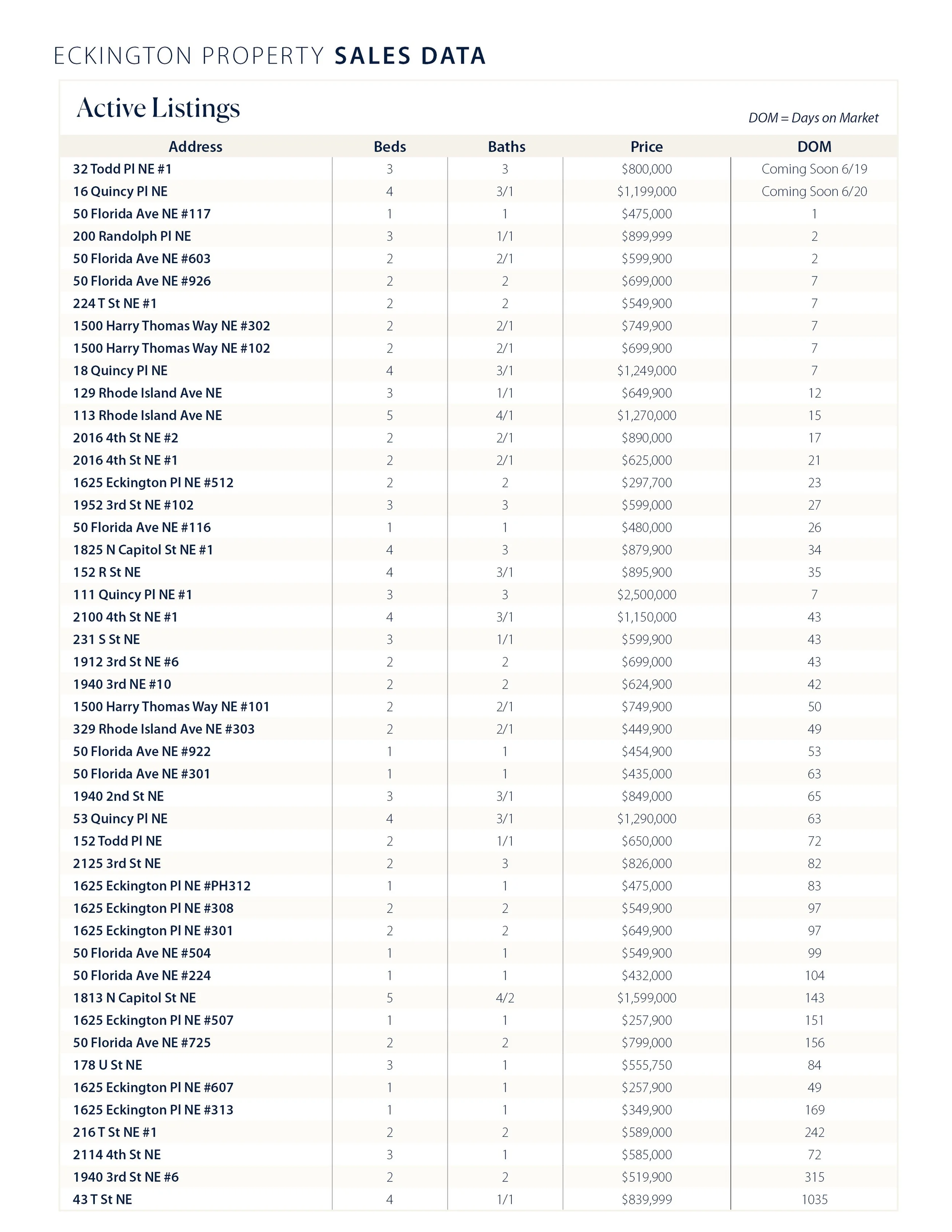

I can’t believe it’s almost Labor Day! How did that happen so fast? It might sound wild, but there are only 86 days between Labor Day and Thanksgiving—more on why that matters for selling or buying below. This week we have 44 Active Listings which is the same as last time. Closings in the last 30 days went from 12 to 6.

Mortgage rates continue to be big news. The Fed announced that they may start decreasing rates as soon as this Wednesday. Because the jobs report was worse than expected and inflation fell below 3%, they are looking to head off an economic stall. Many experts predict that the cut on Wednesday could be as much as half a point, with another possible cut in December. This could bring rates down by a full point, which would likely set the market into motion pretty quickly. Many people have been sitting on the sidelines, waiting for this moment.

As of Friday, August 23 2024, the current average interest rate for a 30-year fixed mortgage is 6.44%. *We source this data from Mortgage News Daily.

Timing is Everything: Why You Need to Act Fast This Fall

Okay, so here's the situation: there are only 86 days between Labor Day and Thanksgiving, and we have an election in the middle of that. 🤯 I would argue that people are going to check out early this year—by Election Day, they'll likely be rolling right into holiday mode, eating and drinking too much. This isn’t a lot of time, especially with people's minds on other things. If you're a seller or want to sell, you need to hit this window, which means getting your property on the market as soon as possible.

A good fall listing should aim to hit the market in mid to late September. If we need to work through listing prep and other details, you should allow yourself a few weeks for that. But it’s not all bad news—rates are expected to come down as soon as this Wednesday. I expect that lower rates will start to drive buyers out for DC’s typical seasonal fall real estate burst.

So, what am I saying? I’m saying if you want to sell, you need to get moving and start this process now. Like right now!

If you’d like to chat more about the listing process, timing, or anything else, Alex and I are here for you. Just send me a text at 410.591.0911

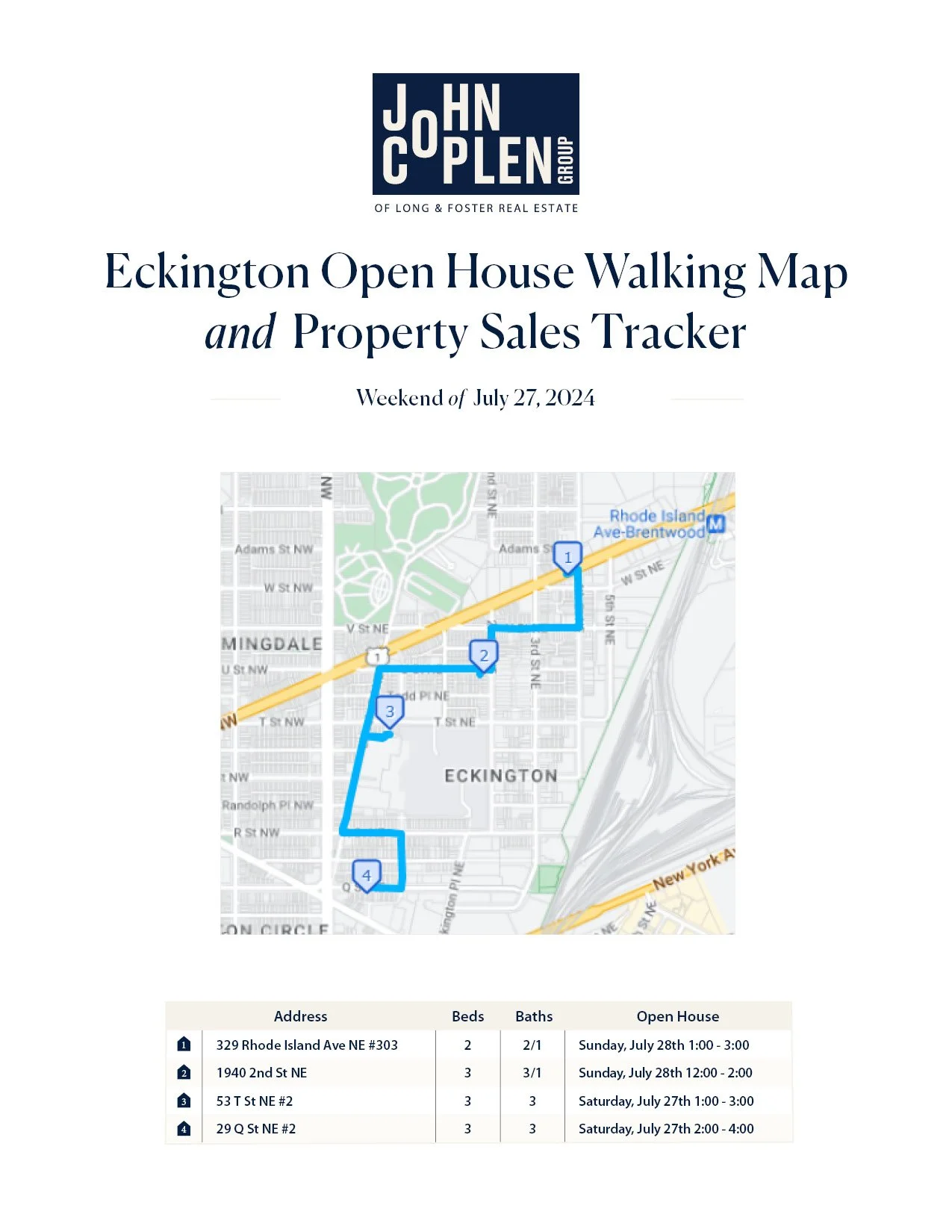

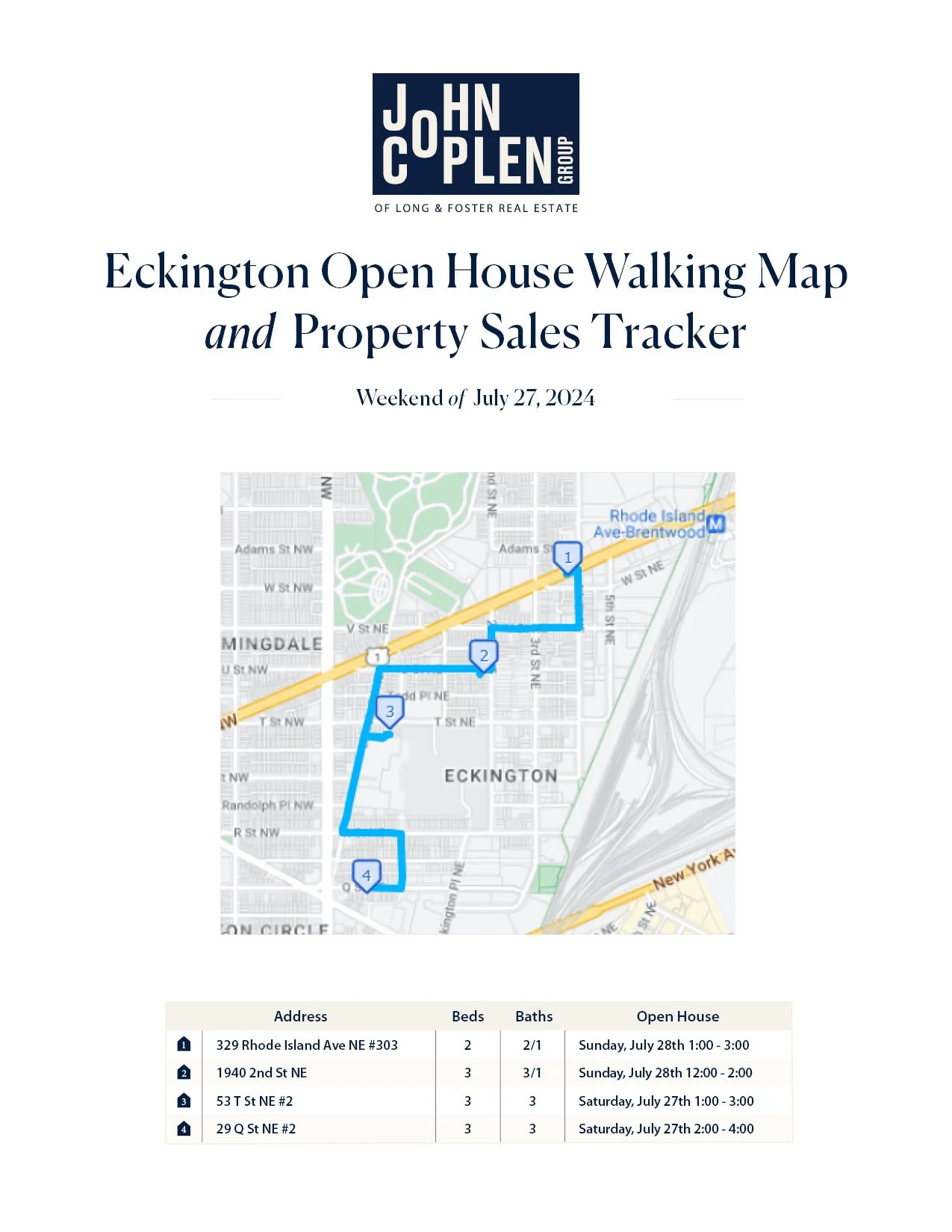

Eckington By The Numbers || Weekend 07.26.202

If you're planning to put your home up for sale in August, one of the hottest months in DC, please keep a few tips in mind:

Keep It Cool: Ensure the air conditioning is functioning well and keep the interior temperature comfortable for showings.

Highlight Outdoor Spaces: Stage patios, decks, and gardens with furniture and accessories to showcase outdoor living areas.

Maximize Natural Light: Open curtains and blinds to let in as much natural light as possible, making the home feel bright and airy.

Use Summer Scents: Use fresh, light scents like citrus or lavender to create an inviting atmosphere. However, don't overdo it or attempt to mask bad smells.

Add Extra Outdoor Plants and Pots: Add some beautiful flowers. Pots are easy to care for and a great way to make any outdoor space more welcoming.

Some good news about rates! We are dropppiong below 7% and heading in the right direction. As of Friday, July 26 2024, the current average interest rate for a 30-year fixed mortgage is 6.86%. *We source this data from Mortgage News Daily.