Eckington By The Numbers || Weekend 10.05.2024

We've made some adjustments and can now deliver this report on Friday afternoons, which works much better for the Open House Tracker we provide.

Also, just a reminder that tomorrow is Eckington Day! It’s definitely worth a visit. The agenda is below.

Alethia Tanner Park Saturday October 5

11:30 AM - 12:30 PM

DC Fire "Touch a Truck"

12:00 PM - 12:30 PM

Free Salsa Lesson

12:30 PM - 1:00 PM

1-Mile Fun Run on the MBT

Starting and ending at Alethia Tanner Park

1:30 PM - 2:30 PM

Pet Costume Parade

2:00 PM - 3:00 PM

Free Yoga Class (2:15 PM - 3:00 PM)

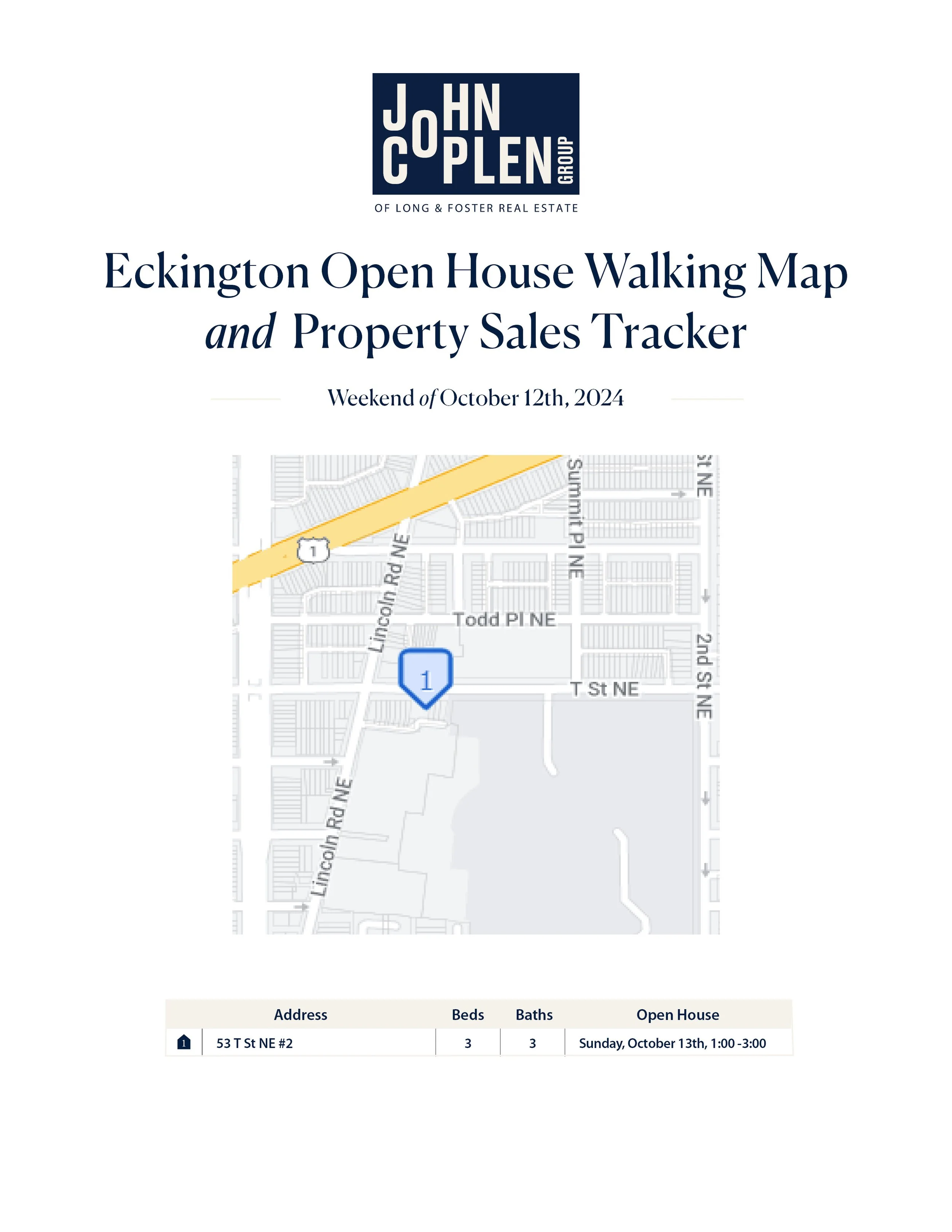

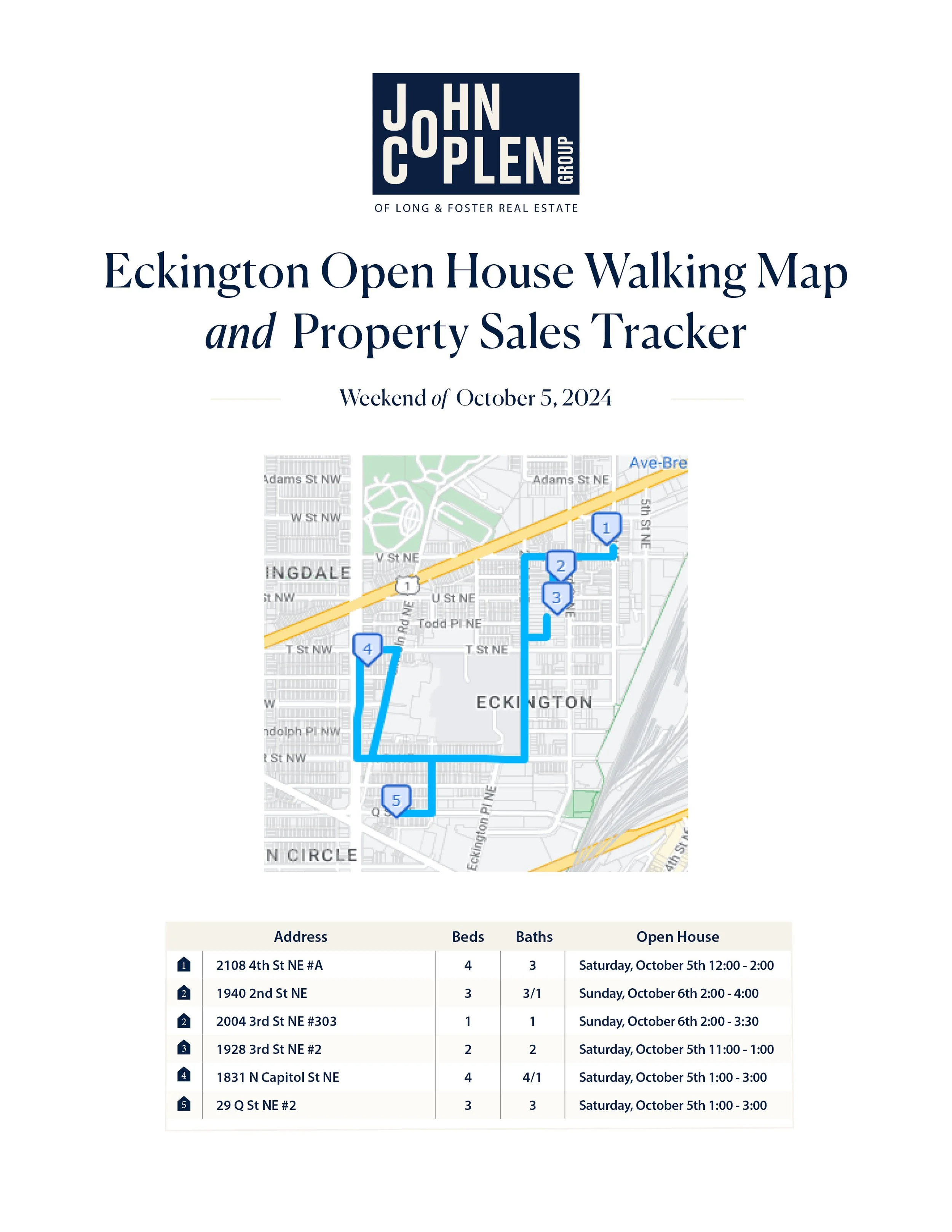

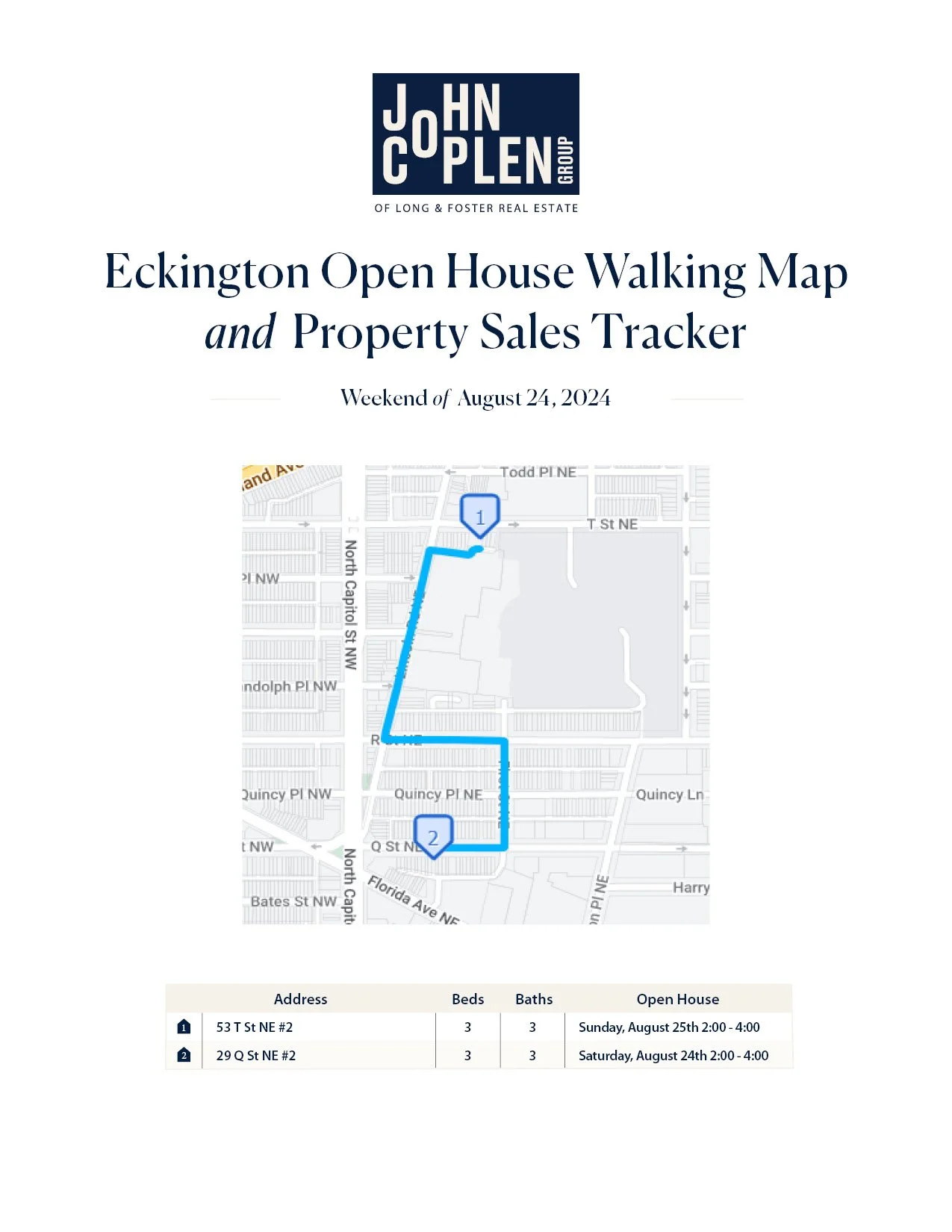

DOWNLOAD FULL PDF of the ECKINGTON SALES TRACKER & OPEN HOUSE GUIDE // CLICK HERE

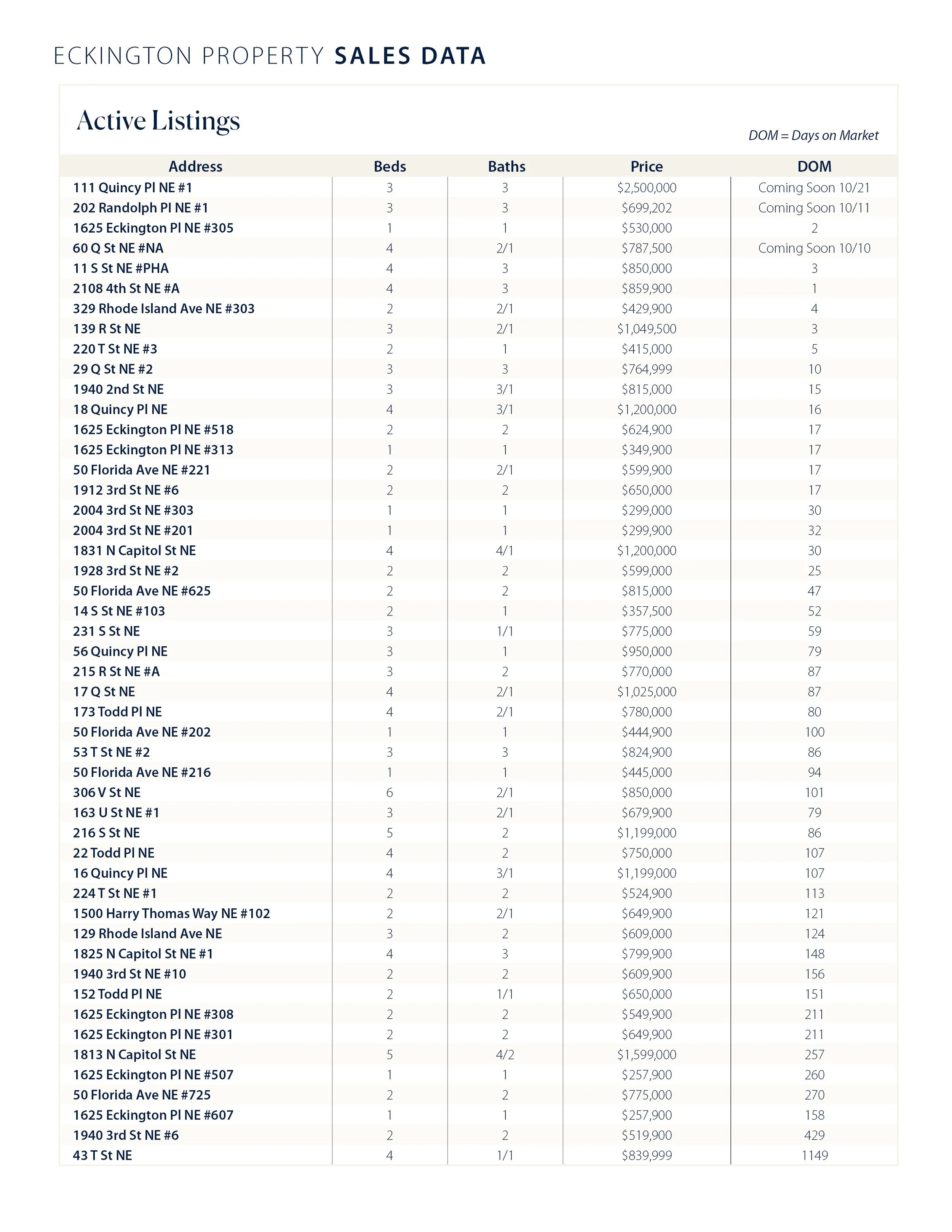

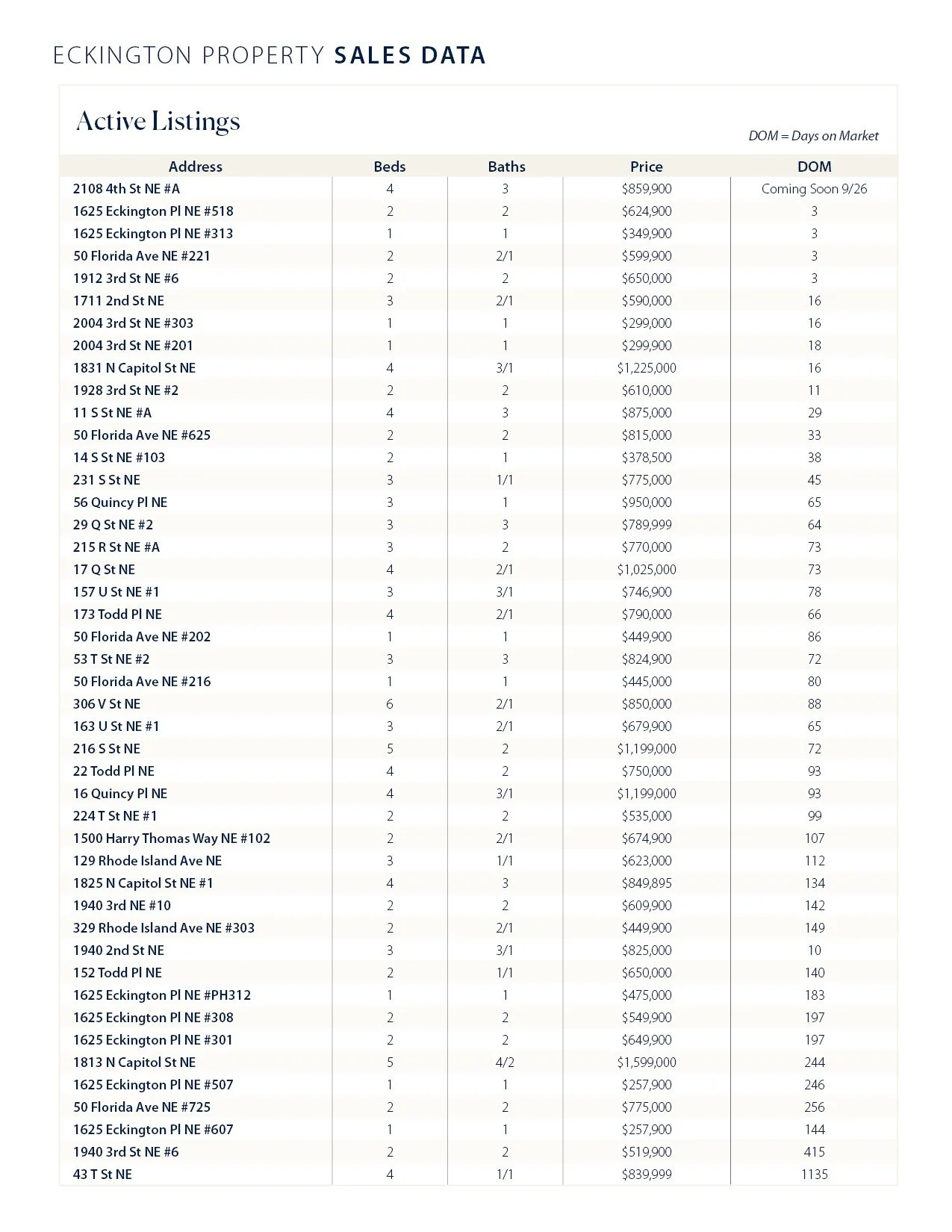

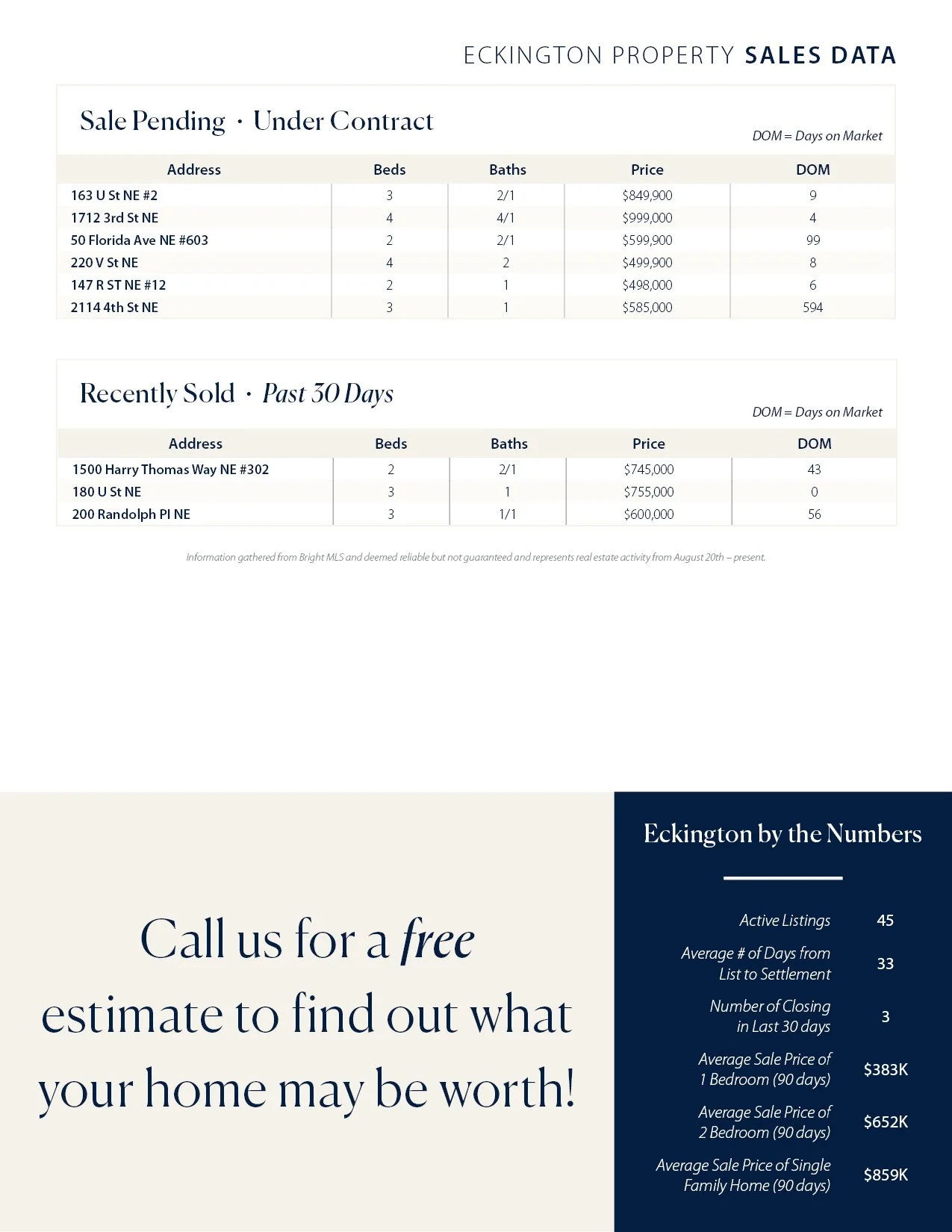

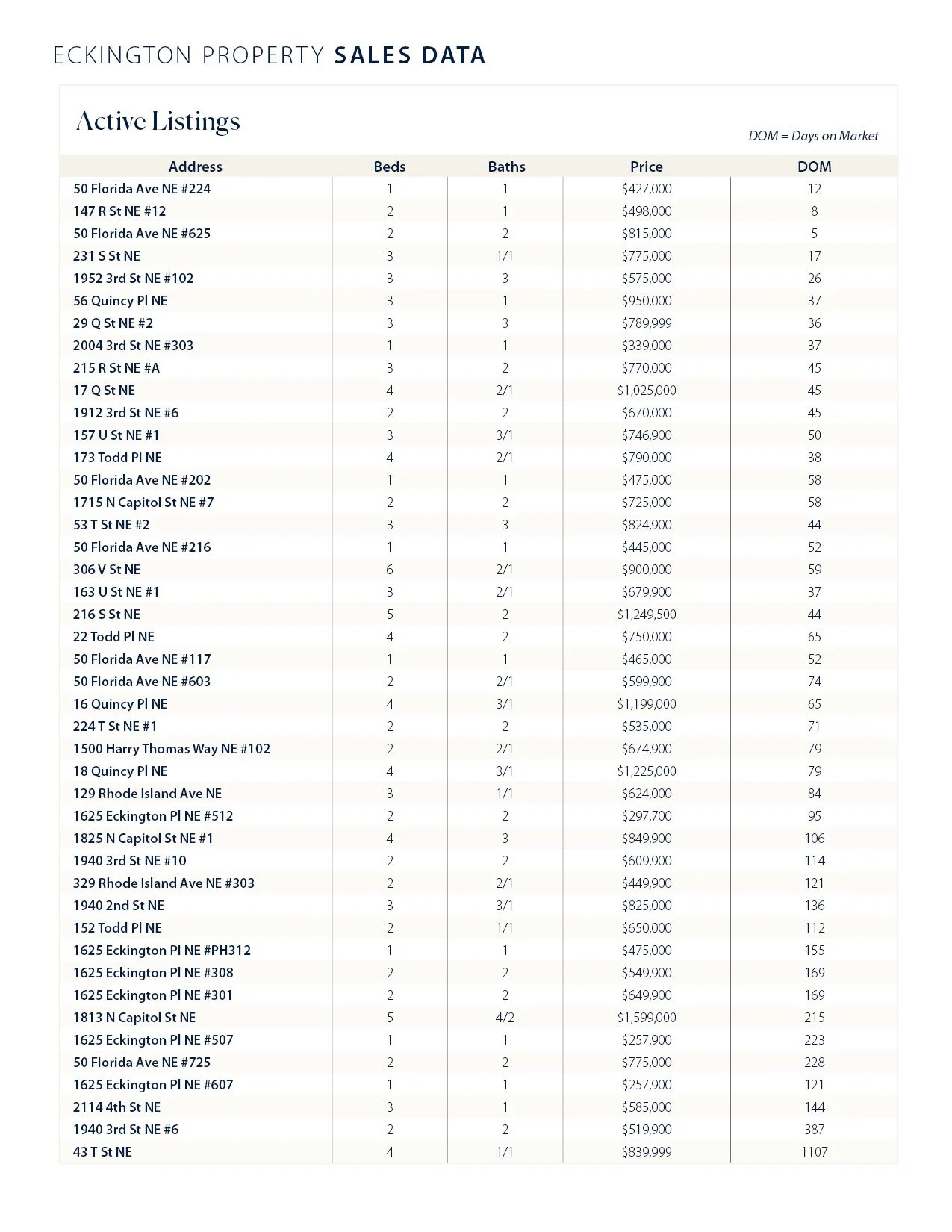

As expected, we’re seeing a somewhat muted fall market. This is largely due to many buyers holding off, waiting for interest rates to drop and factoring in the upcoming election year. Currently, there are 49 active listings in Eckington, but we’ve had zero closings in the last 30 days. I believe this is the first time we've seen that since we started tracking this data almost five years ago. That alone shows how hesitant people are right now.

I stand by my previous point: if you’re a savvy buyer, now is the time to go hard and find the right place. Buy when things are quiet, secure a great deal on the property, and refinance when rates come down next year. You can always renegotiate the rate, but you're locked into the sales price.

Check out the video below on current rates for more information.

Eckington By The Numbers || Weekend 09.20.2024

The Federal Reserve Just Cut Rates for the First Time Since COVID

Let that sink in. Doesn't COVID feel like a lifetime ago? Well, that’s exactly why the real estate market has been facing so many headwinds. Rates peaked on October 19, 2023, with an average 30-year fixed mortgage at 8.01%. Those high rates not only made buyers pause, but sellers too. Why list your home if you’ll be facing a smaller pool of buyers and then have to buy in the same tough market?

So, what does this first rate cut of half a point mean? It means we're starting to see a shift. And now is the perfect time to take advantage of this changing market in ways you might not expect.

Where are rates now?

Currently, we’re seeing an average of 6% for a 30-year fixed mortgage. With the recent Fed cut and continued positive news on inflation, market rates are likely to dip even further. This slight downward shift will bring more buyers into the marketplace, especially as we head into the fall. Even though the upcoming election might make some hesitant, I believe we’ll see an uptick in activity.

Looking ahead to 2025

The Federal Reserve is widely expected to cut rates again before 2025. By the time spring rolls around, rates could be significantly lower. That’s when I predict the DC real estate market will be full speed ahead—think multiple offers, waived contingencies, and even bidding wars.

If you’re a seller, you might be thinking, "I’ll wait and sell then." That could work if you’re not buying at the same time. But if you are buying, there’s a sweet spot right now where rates are coming down and property values are more balanced. Buyers in certain segments may even find properties below market value.

I believe this window of opportunity lasts until January. After that, things will heat up fast. This is one of those rare moments when you get to choose your market conditions. So, what kind of market do you want to buy in? The choice seems clear to me—don’t sleep on this!

Eckington By The Numbers || Weekend 08.17.2024

Happy Sunday, Eckingtonians!

I can’t believe it’s almost Labor Day! How did that happen so fast? It might sound wild, but there are only 86 days between Labor Day and Thanksgiving—more on why that matters for selling or buying below. This week we have 44 Active Listings which is the same as last time. Closings in the last 30 days went from 12 to 6.

Mortgage rates continue to be big news. The Fed announced that they may start decreasing rates as soon as this Wednesday. Because the jobs report was worse than expected and inflation fell below 3%, they are looking to head off an economic stall. Many experts predict that the cut on Wednesday could be as much as half a point, with another possible cut in December. This could bring rates down by a full point, which would likely set the market into motion pretty quickly. Many people have been sitting on the sidelines, waiting for this moment.

As of Friday, August 23 2024, the current average interest rate for a 30-year fixed mortgage is 6.44%. *We source this data from Mortgage News Daily.

Timing is Everything: Why You Need to Act Fast This Fall

Okay, so here's the situation: there are only 86 days between Labor Day and Thanksgiving, and we have an election in the middle of that. 🤯 I would argue that people are going to check out early this year—by Election Day, they'll likely be rolling right into holiday mode, eating and drinking too much. This isn’t a lot of time, especially with people's minds on other things. If you're a seller or want to sell, you need to hit this window, which means getting your property on the market as soon as possible.

A good fall listing should aim to hit the market in mid to late September. If we need to work through listing prep and other details, you should allow yourself a few weeks for that. But it’s not all bad news—rates are expected to come down as soon as this Wednesday. I expect that lower rates will start to drive buyers out for DC’s typical seasonal fall real estate burst.

So, what am I saying? I’m saying if you want to sell, you need to get moving and start this process now. Like right now!

If you’d like to chat more about the listing process, timing, or anything else, Alex and I are here for you. Just send me a text at 410.591.0911