A Question on Federal Workforce Reduction....

We’re tackling a big one today—a topic that keeps coming our way and is impacting so many people we know directly. We recently received the message below from a past client, so we dug into the data to see what’s really happening. And, shockingly enough… don’t believe everything you read on social media!

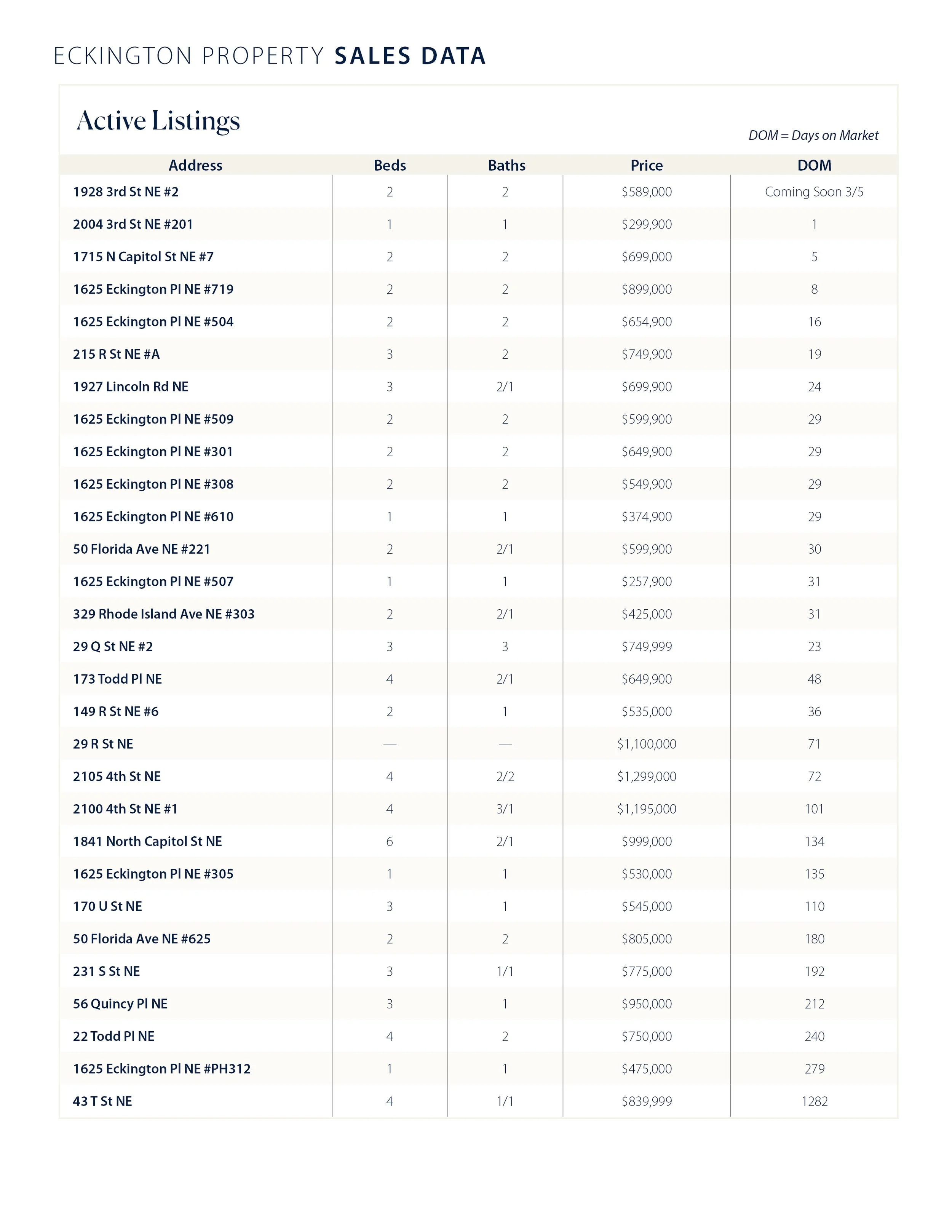

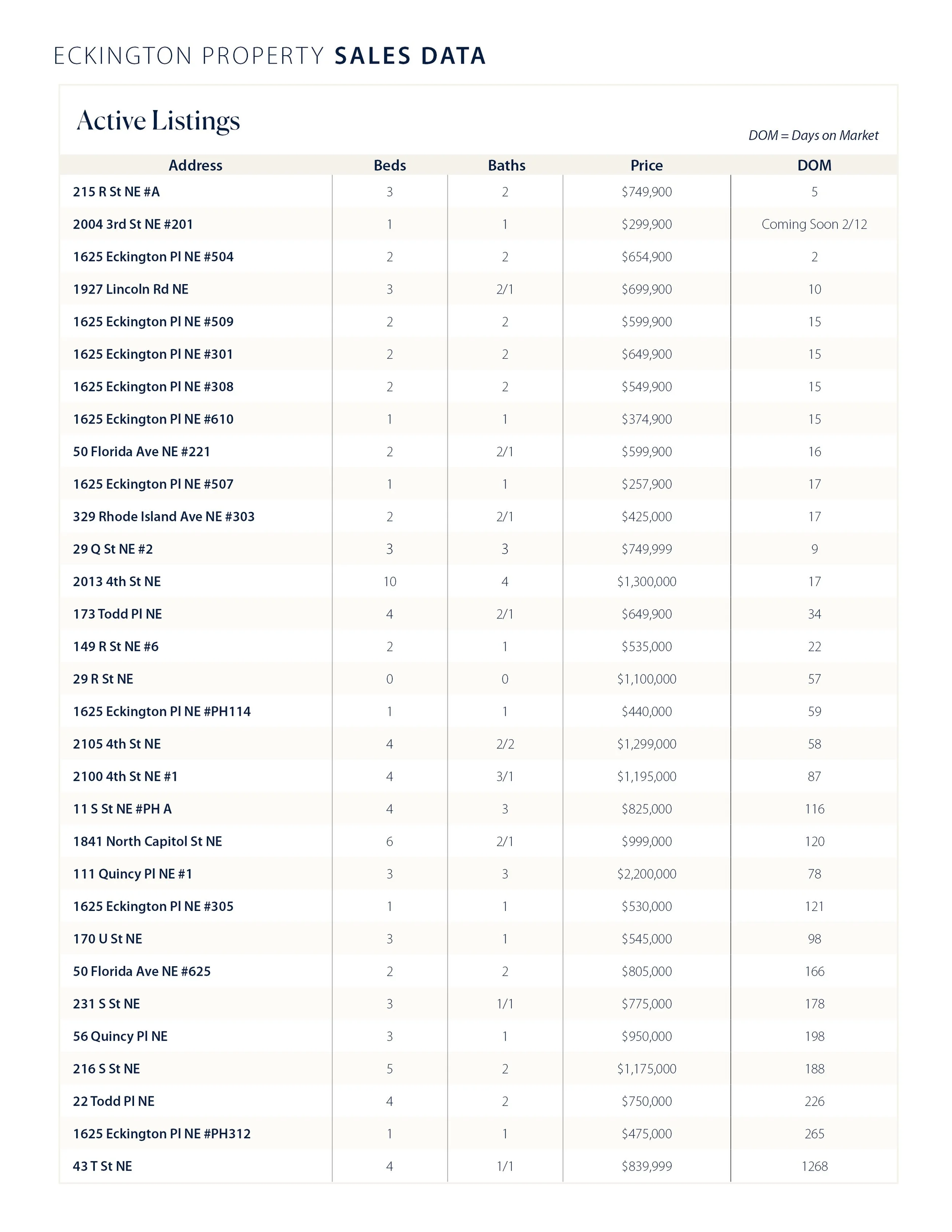

The numbers tell a different story. From what we’re seeing, this is shaping up to be a better buyer’s market than last year.

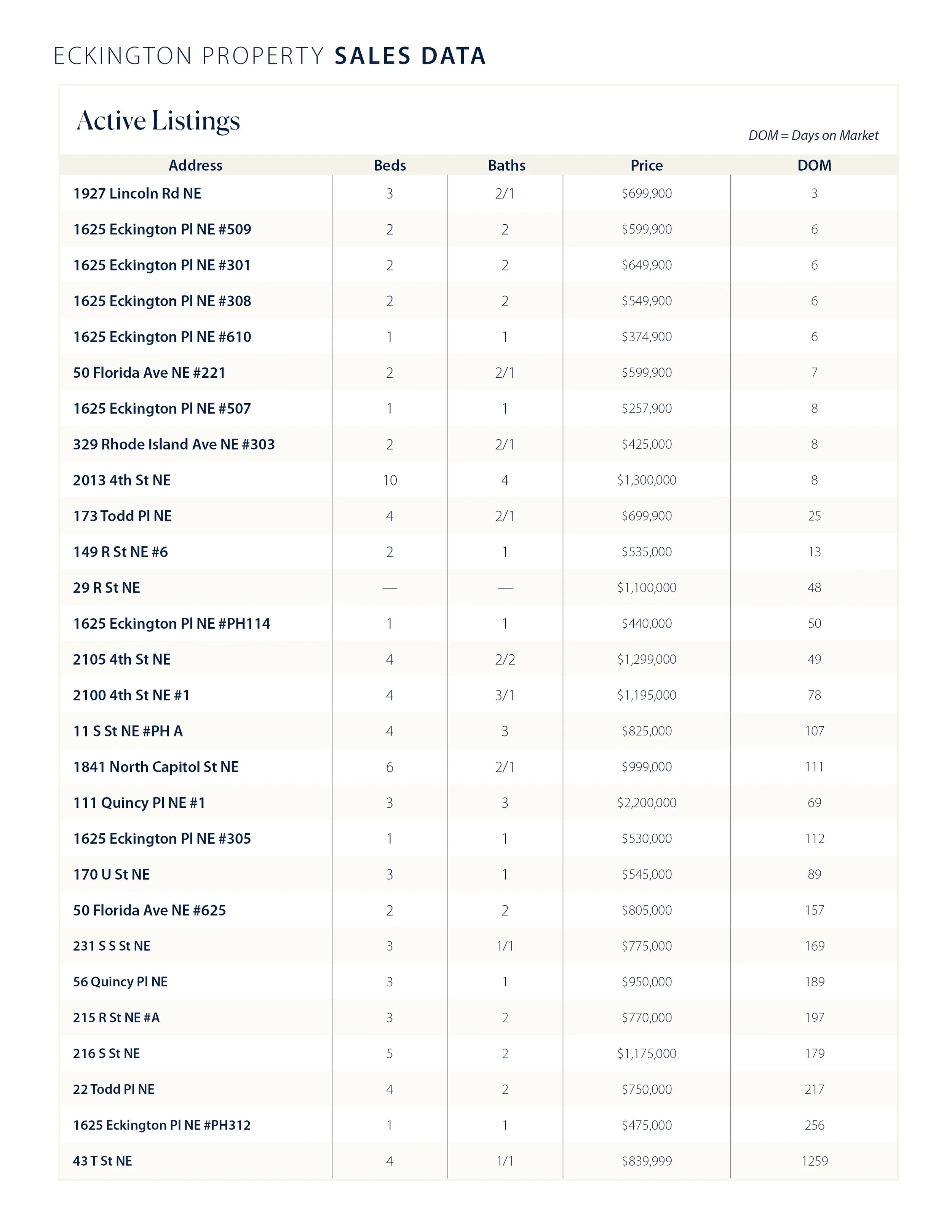

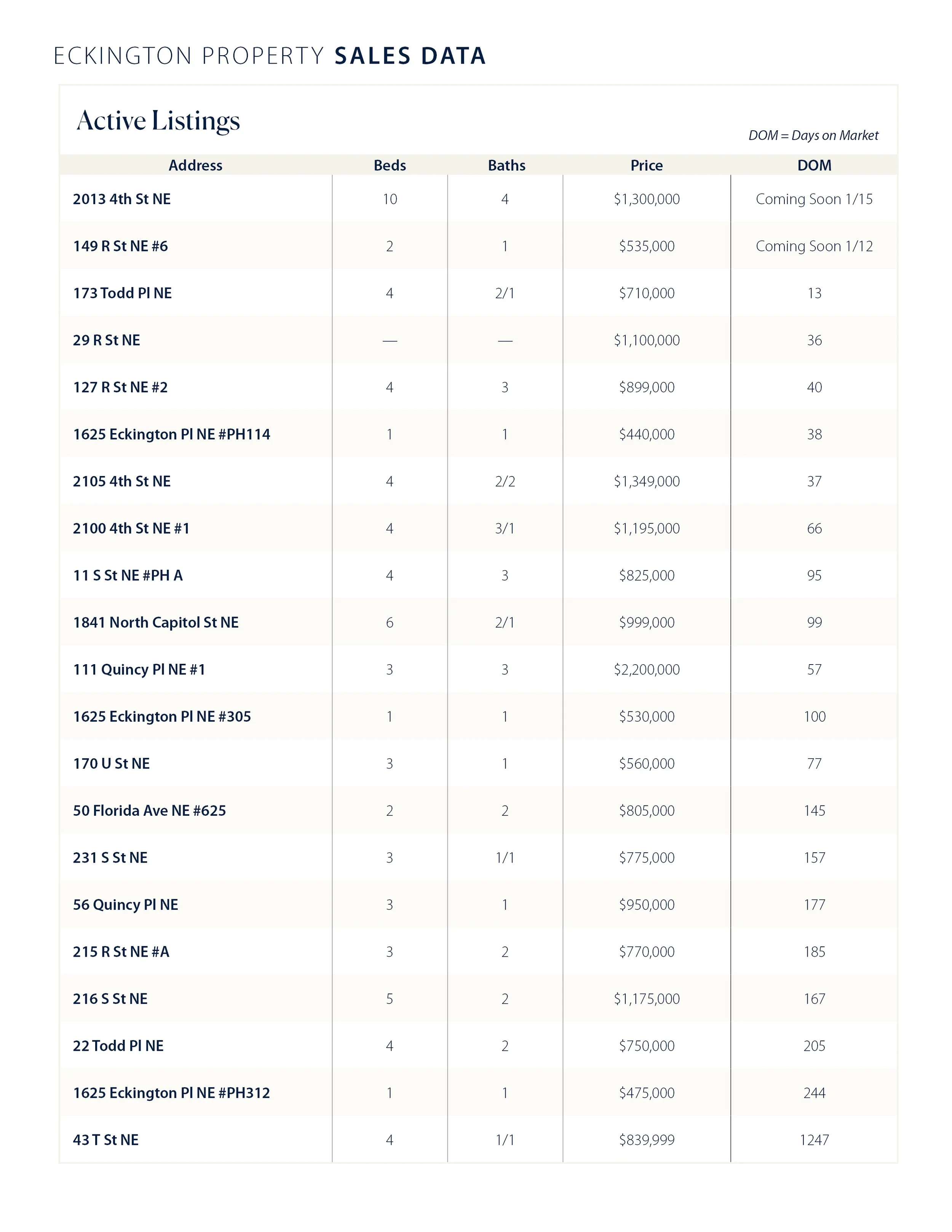

Washington, DC: Currently, there are 2,101 homes listed for sale, with 455 closings in January 2025, compared to 386 closings in January 2024.

Inside the Beltway: There are 3,413 homes for sale, with 1,008 closings in January 2025—an increase from 909 closings in January 2024.

This aligns with how the market feels right now. Last year was tough—many buyers sat on the sidelines, waiting for interest rates to drop, home prices to adjust, and the election to pass. Now, it seems like people are moving because they have to, and we’re seeing some adjustments in home values.

So, what about prices?

In Washington, DC, the average sold price in January 2024 was $847,857, with an average of 83 days on the market.

In January 2025, the average sold price dipped slightly to $844,365, while the average days on market dropped to 56.

While the price shift is small, it does show a slight downward trend in values, and the drop in days on market suggests that homes are selling faster—a sign of a more active market.

Overall, what we’re seeing doesn’t match the narrative in that post. That doesn’t mean there won’t be an impact from the federal government downsizing its workforce, but statistically, those effects haven’t fully played out yet. It’s just too early to say. Other factors, like the return-to-office requirements, could also bring more people back into the DMV for work.

We’ll continue to watch the data and keep you updated. If you have questions about the market or your plans this year, let’s chat!