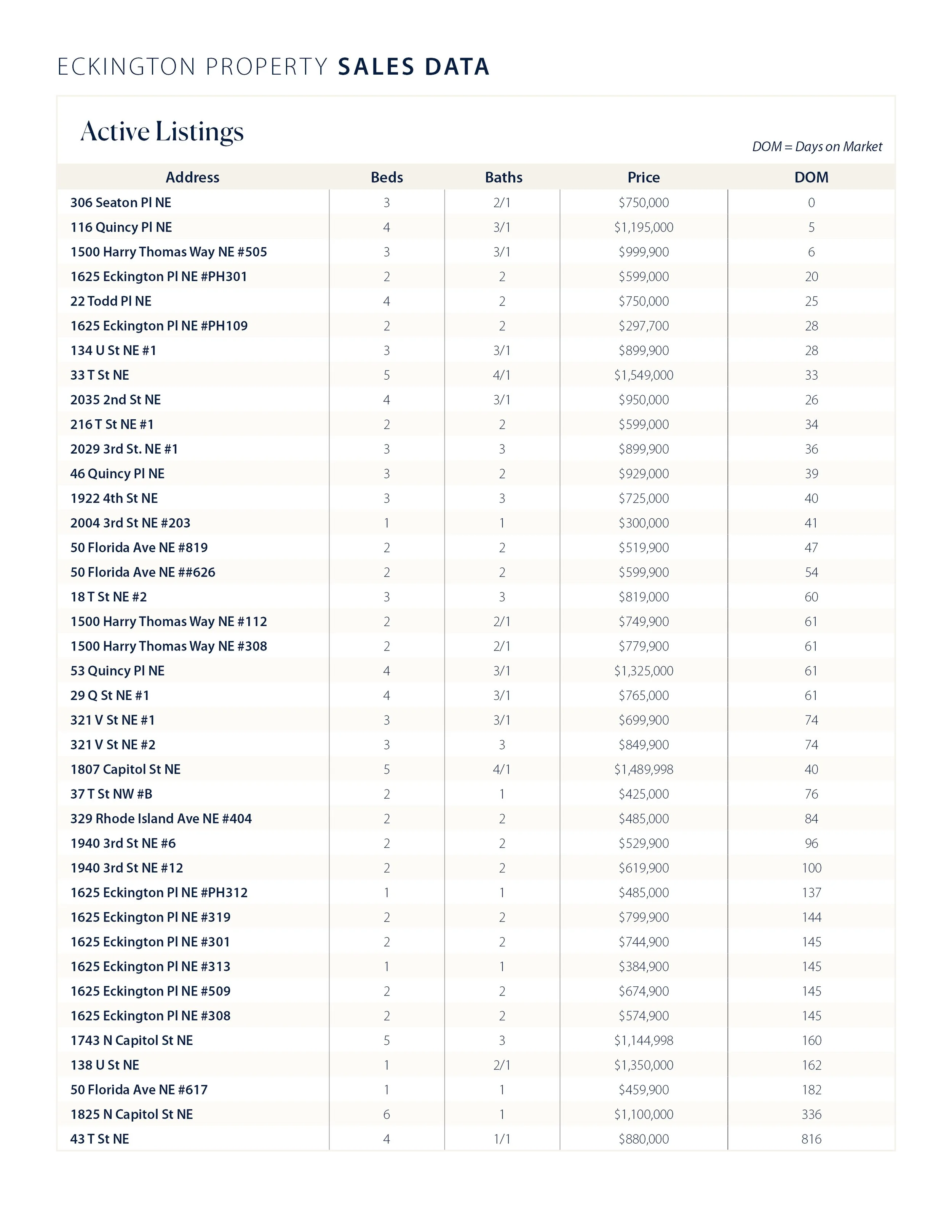

Eckington By The Numbers || Weekend 12.17.23

The final stretch of 2023! Taking a look at Eckington's data this week, the number of active listings dropped from 31 to 25, and there have been a total of 6 closings in the last 30 days. The average days on the market droped to 25. There are no open houses set for this weekend. Not unusual for this time of year.

The big news this week is the rates. They continue to drop. As of Friday, the average 30-year rate hit 6.64%, down from an October 18th high of 8.01%. If it weren't for the weeks before the holidays, this would drive a lot of folks out. I will be interested to see where rates land after the new year and if the downward trend will continue.

If anyone has more detailed quetions about the market that we do not cover in the weekly email, please always feel free to reach out. Both Alex and I are happy to chat.

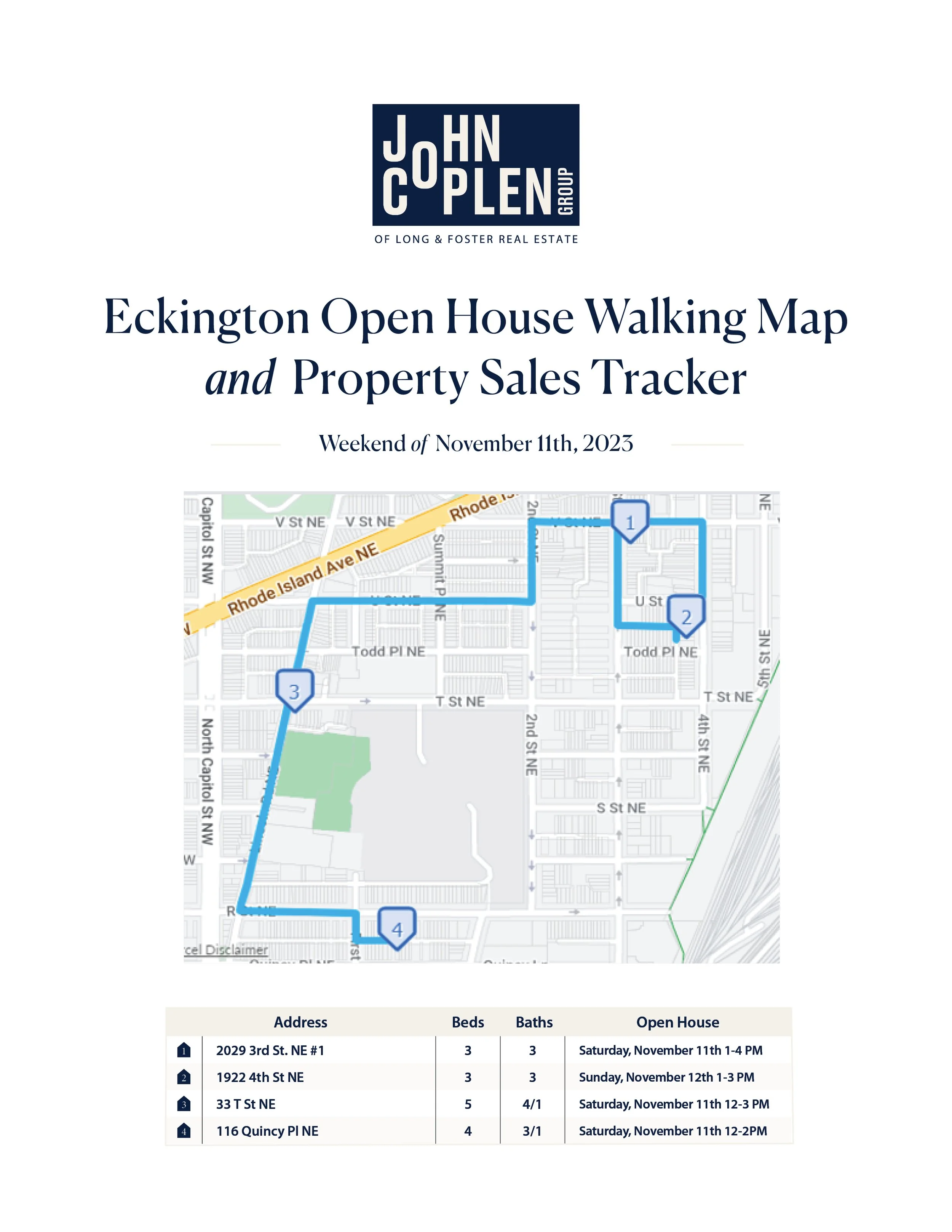

Eckington By The Numbers || Weekend 11.19.23

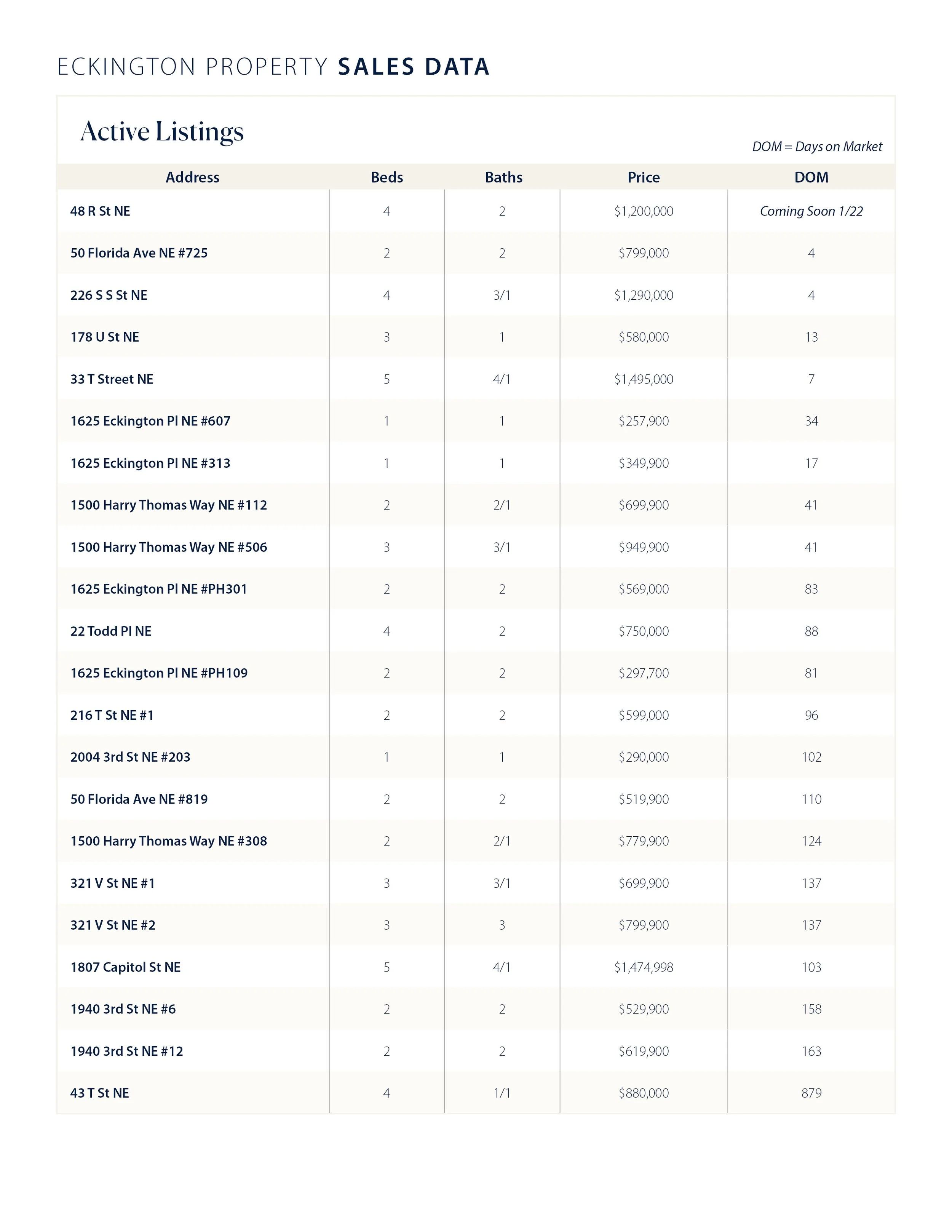

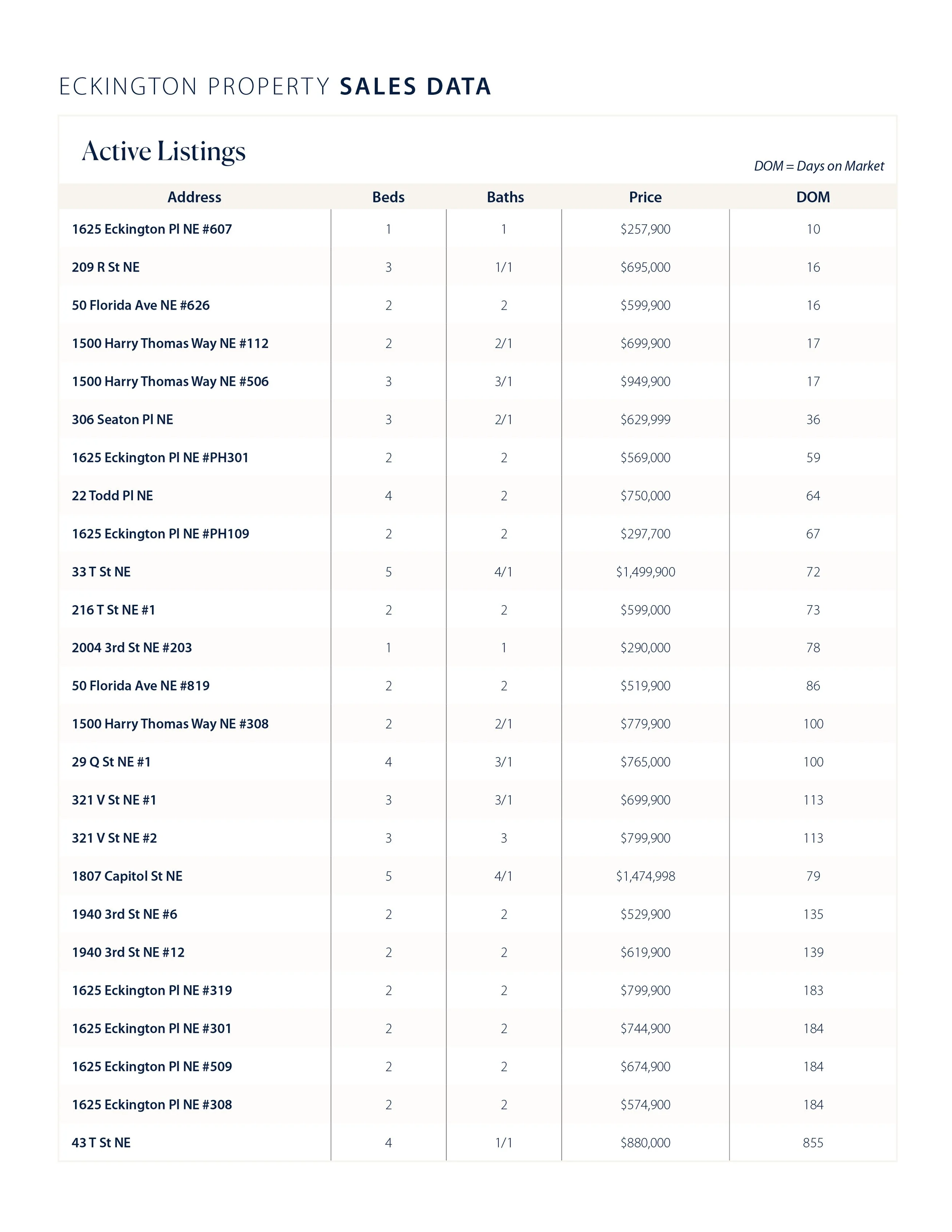

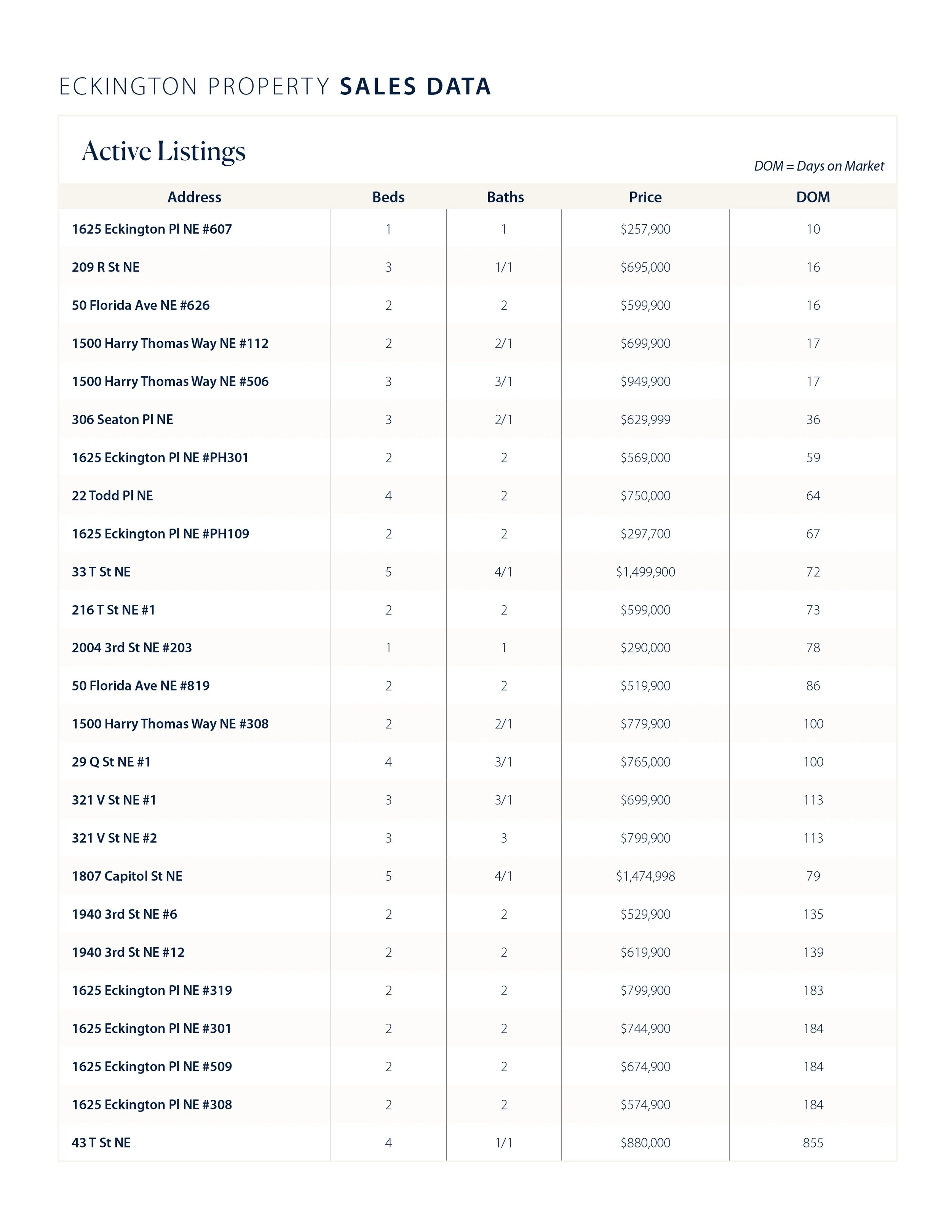

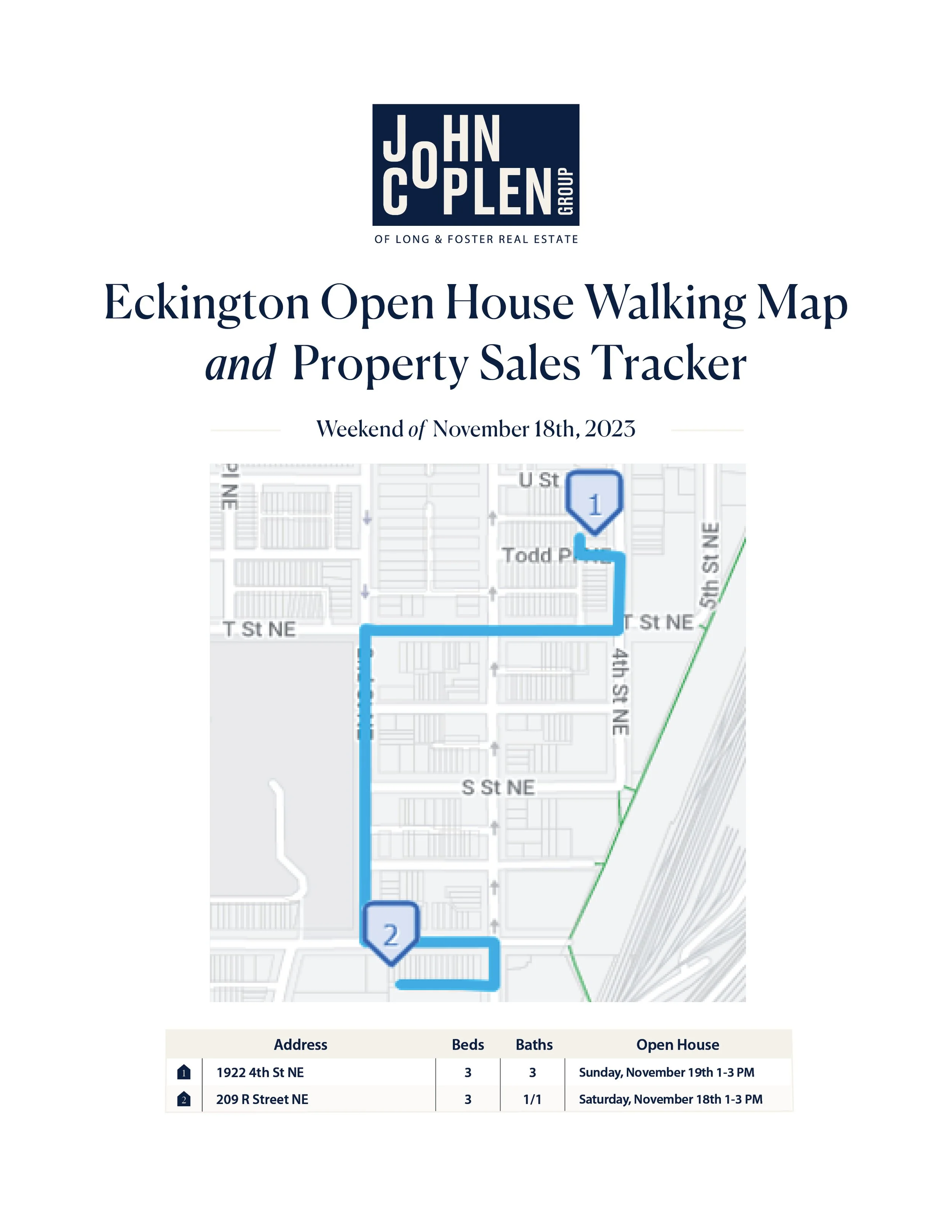

Taking a look at Eckington's data this week, the number of active listings remained at 39, and there have been a total of 8 closings in the last 30 days. The average days on the market moved from 49 to 62. This increase in days on market is common as we head into the holidays so I would not read too much into that.

Although it might seem a bit early, in terms of real estate timing, spring is just around the corner. We've had several inquiries from folks looking to list their property next spring, asking how they can get a head start this winter to avoid feeling rushed. Here are a few proactive steps you can take now:

Start Researching: Begin by exploring local market trends and recent sales in your area that compare to your house. This will give you an idea of where your home stands in the market.

Interview Agents: Compile a list of three agents and interview each one. Ask them the same questions, review their marketing plans, and determine the best fit for your needs.

Declutter and Organize: Start decluttering and organizing your home by getting rid of unnecessary items. This is an essential step and the holiday season is a great time to donate quality items you no longer need.

Repair and Maintenance: Take care of any necessary repairs or maintenance tasks around the house. Fix leaky faucets, repair minor damages, and ensure everything is in proper working order.

Get a Pre-listing Inspection: Consider arranging a pre-listing inspection to identify any potential issues before listing your home. This proactive step can prevent surprises once you're under contract, something we've seen happen often."

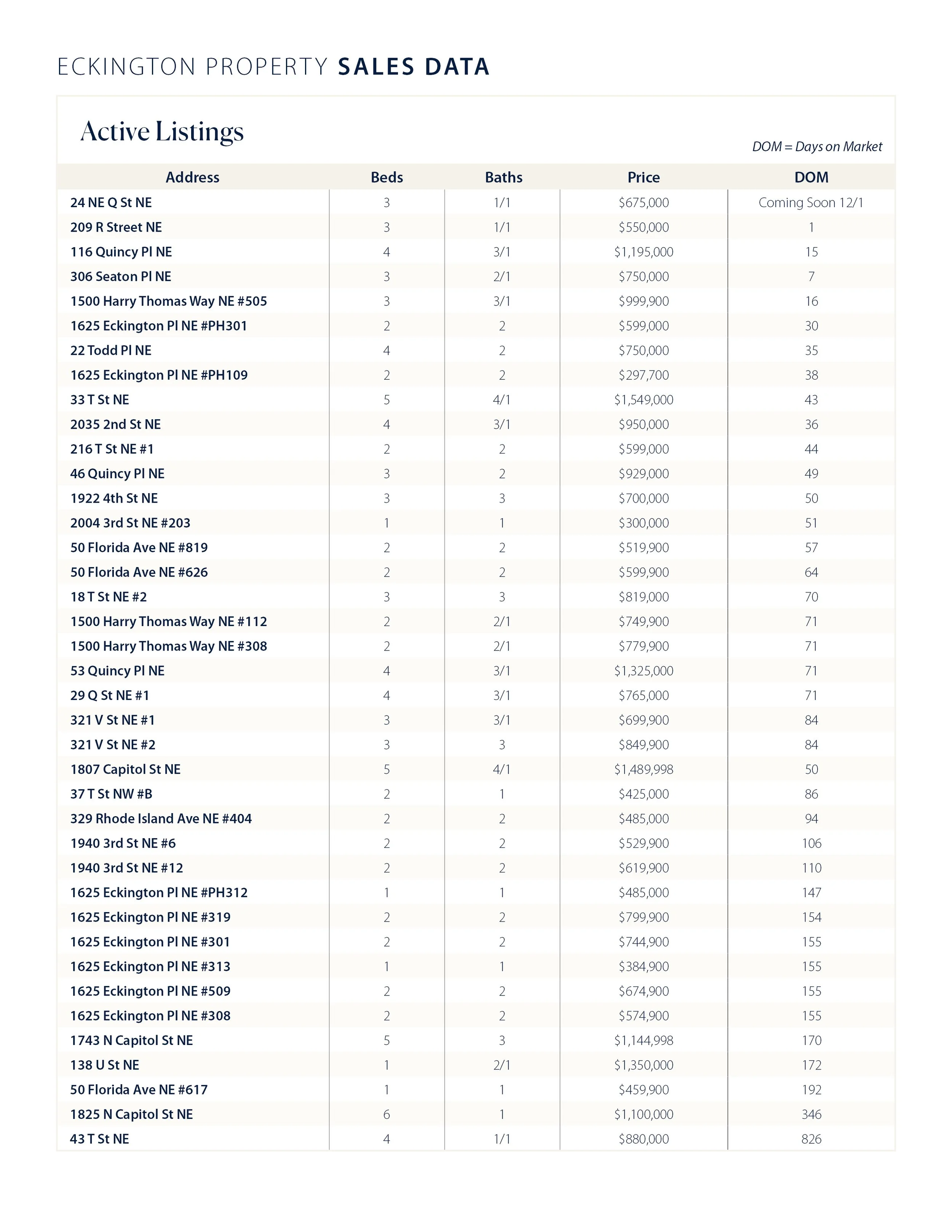

Eckington By The Numbers || Weekend 11.11.23

We often hear that the holiday season is not a great time to list your property, but I would argue there are some big advantages.

Holiday Curb Appeal: Enhance the exterior of your home with festive decorations and well-maintained landscaping to attract potential buyers during the holiday season.

Warm and Cozy Atmosphere: Create a welcoming ambiance inside your home soft lighting, and perhaps a crackling fire in the fireplace to make potential buyers feel at home.

Year-End Tax Benefits: Highlight the potential tax advantages of purchasing a home before the year ends, emphasizing the financial benefits of closing the deal during the holiday season.

Less Market Competition: Point out that the holiday season often sees fewer homes on the market, providing your property with a competitive edge and potentially attracting more serious buyers.

New Beginnings for the New Year: Emphasize the idea of a fresh start in a new home for the upcoming year, appealing to buyers who may be looking to make a significant change in their lives.

Emphasize Indoor Spaces: Showcase the interior of your home by staging key rooms for winter, allowing potential buyers to envision themselves celebrating holidays in the space.

Holiday Home Tours: Consider hosting open houses or private tours with holiday-themed refreshments to make the home-buying process more enjoyable for potential buyers.

Motivated Buyers: Many individuals looking to purchase during the holiday season are often motivated by a specific timeline, such as relocating for a job or taking advantage of year-end financial considerations.

Negotiation Leverage: Position your home as a desirable option, noting that serious buyers may be more willing to negotiate and close a deal during the holiday season, potentially resulting in a quicker and smoother transaction.

Eckington By The Numbers || Weekend 11.05.23

Taking a look at Eckington's data this week, the number of active listings dropped from 40 to 41, and there have been a total of 9 closings in the last 30 days. The average days on the market jumped from 37 to 49. As we head into the holiday season, I would expect the inventory to drop some and the days on the market to rise. Every year I tell buyers this is a great time to buy if you can stay focused. There is often less competition in the market.

Some good news for buyers and sellers is that the Federal Reserve (Fed) decided to hold rates steady at last Wednesday's meeting. We often get a lot of questions about how rates work, so here is a quick overview. The Fed's set interest rates have a significant influence on mortgage rates, but they are not directly tied to each other. Mortgage rates are primarily determined by the broader bond market and investors' perceptions of risk and return in the housing market. When the Fed raises or lowers its benchmark interest rate, it affects the overall cost of borrowing money in the economy, including banks' cost of funds. As a result, mortgage rates tend to move in the same general direction as the Fed's policy rate changes. However, they can be influenced by other factors like economic indicators, inflation expectations, and demand for mortgage-backed securities. So while Fed rates provide a crucial backdrop, mortgage rates can vary independently, often resulting in disparities between the two. This directly impacts buyers, as for every rate hike, it means less house a buyer can afford. This move dropped the 30-year average fixed rate from 7.88% last Friday to 7.38% this Friday.

Here is a recnet article on the Fed's last meeting: https://www.reuters.com/markets/us/fed-poised-hold-rates-steady-despite-economys-bullish-tone-2023-11-01/

As of Friday, November 3, 2023, the current average interest rate for a 30-year fixed mortgage is 7.38%. *We source this data from Mortgage News Daily.

Eckington By The Numbers || Weekend 10.28.23

Taking a look at Eckington's data this week, the number of active listings dropped from 42 to 40, and there have been a total of 7 closings in the last 30 days. The average days on the market jumped from 15 to 37. This is further evidence that homes will move if priced right, just at a slower pace than what we are used to in the typical DC market.

We're also noticing numerous options available from lenders to help individuals secure a slightly lower interest rate now, with the idea that rates will potentially come down in the future, allowing for refinancing. One particularly popular option is the 3-2-1 Buydown. This unique mortgage financing strategy is designed to reduce your initial monthly mortgage payments, making them more manageable during the early years of your home loan. Here's how it works:

Year 1: You enjoy a significant reduction in your interest rate, a full 3 percentage points below the standard rate.

Year 2: Your interest rate continues to be favorable, now lowered by 2 percentage points below the standard rate.

Year 3: The interest rate is further reduced, this time by 1 percentage point below the standard rate.

This approach provides short-term payment relief, helping you transition into homeownership smoothly and efficiently. It's an excellent option for those looking to enter the housing market with more financial flexibility.